Executive Summary

Today, there is an increasing realization among IoT adopters and vendors that the various constituent elements of an IoT solution must be delivered as a managed service or series of managed services. This white paper looks at why enterprises should be more selective about demanding a more personalized service and picking their IoT connectivity partners.

Your IoT Deployment

The key findings are as follows:

- The best way to deliver IoT is as a managed service. Simply throwing an increasingly complex array of hardware, middleware platforms, connectivity options and cloud architectures at an enterprise and expecting them to piece together their own IoT solution is, at best, fanciful. IoT is a non-core area for almost every adopter, so some element of hand-holding is critical.

- The days of the infinitely scalable IoT platform are gone. IoT is a service rather than a product business; such is the necessity for customization to meet clients’ requirements. This means fewer unicorn platform companies and more service-oriented companies resolving real-world client requirements.

- Cross-optimization of solution elements is critical. Technological and commercial developments mean that support for enterprises deploying IoT will be increasingly multidisciplinary, involving the cross-optimization of many different solution elements, including devices, device management, connectivity (including multibearer), application enablement, cloud integration, edge computing, protocols and application logic.

- The need to cross-optimize also means better fault resolution. The organization responsible for ensuring the different elements of IoT applications work together is also well placed to iron out one of the main challenges of IoT: fault resolution in a multivendor environment, avoiding the blame game that dogs many IoT deployments.

- Not all vendors are equal. The degree of presales and postsales support is a critical differentiator between vendors. On paper, many offerings might look identical, but there is a world of difference between best-in-class and run-of-the-mill despite having the same offering. The best vendors realize that the guidance they provide is as important as the products.

- Context is king. There is a strong tendency amongst IoT vendors to say that they can deliver almost any functionality. Adopters should look for those with heritage and experience in their particular circumstances.

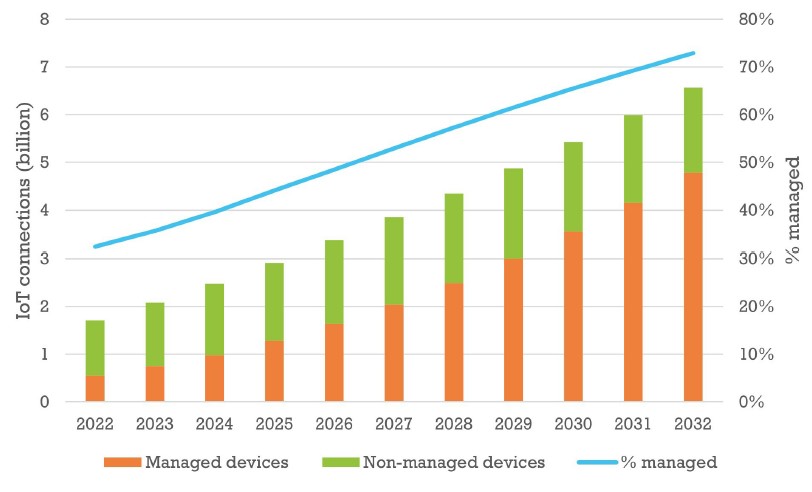

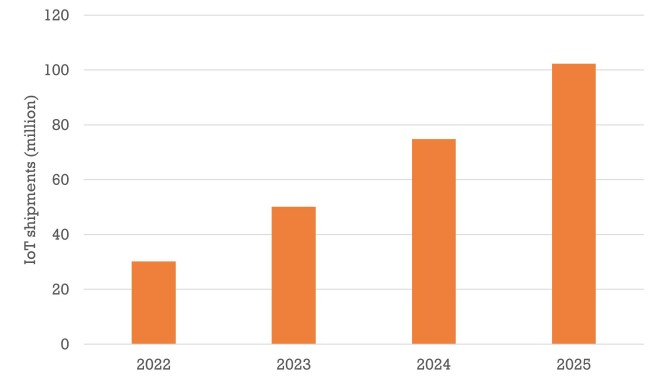

As part of this white paper, we have also tried to quantify a couple of these elements. Firstly, as a result of greater demand, we expect the proportion of IoT connections that are, as we define it, managed connections will grow to more than 70% by 2032, from just over 30% today. The second aspect we looked at was the propensity to require greater bundling of hardware (modules and gateways) with connectivity as a manifestation of the increasing requirement to cross-optimize the different application elements. We expect such bundled offerings to more than triple between 2022 (30 million shipments) and 2025 (100 million).

Table of Contents

Greater Demand for Managed Services

Enterprises demand customization of IoT elements to address their specific requirements. Few have in-house IoT capabilities or interest in building them sufficiently to cope with the increasing complexity of connectivity technology choice, protocol selection, compliance, security or cloud integration. Far better for that to be delivered as a service rather than simply throwing products at the enterprise and hoping some of them stick.

Transforma Insights has recently been researching for its annual Communications Service Provider IoT Peer Benchmarking report, looking at the capabilities and strategies of CSPs in delivering IoT connectivity and other associated services. One notable trend, which has also been manifest in other areas of IoT, has been the greater requirement to provide more customer support, whether it be a full systems integration project, enriched post-sales support or something in between.

It has become well recognized that enterprises need some hand-holding to deploy their IoT projects. This is even more pronounced for mass market deployments in which adopters have little to no direct expertise in IoT.

This extends beyond the initial setup. The same logic applies to ongoing support. Most enterprises need, or would greatly appreciate, a managed solution, not just a set of building blocks. As an example, in the report “Mobile Private Networks can be a long-term commitment needing pro-active management” (March 2022), we at Transforma Insights concluded that the mobile private networks would need to be provisioned in a managed way (i.e., with a service provider of some sort handling deployment, ongoing maintenance, upgrades and so forth). In general, enterprises don’t have the wherewithal or the motivation to develop sufficient expertise in managing such networks. The same is true of almost all aspects of IoT.

The main upshot of this trend is that there is diminishing opportunity for any company to exist as an infinitely scalable IoT platform. Such elements are increasingly commoditized and demanding of a service layer on top of them. Middleware companies are differentiating on vertical sector expertise, and recent years have seen some major technology vendors mothball or close their IoT platform play, including Google IoT Core and IBM Watson IoT.

The future of IoT vendors is in delivering expert, personalized support to enterprises based on the particulars of their deployment. Vendors will continue to use horizontal capabilities as their building blocks to gain some scale, but when interacting with enterprises, customization is key. One good example is Oracle, which chose to pivot from its horizontal IoT offering to instead use said platforms as a tool for building its Fusion Cloud IoT Intelligent Applications. In total, we estimate that a little under one-third of all cellular IoT connections are truly managed today. This figure will increase significantly over the coming decade to around 73% in 2032.

Figure 1: Global IoT connections, 2022-32

[Source: Transforma Insights, 2023]

We define “managed” here as a connection that is actively managed by a service provider within the connectivity management domain, as mentioned above. This involves hosting it on a connectivity management platform and offering a sophisticated set of active management features, including local breakout, data flows and more. The requirements for managed connectivity will typically be higher over time as legacy unmanaged connections are phased out. Multicountry and complex deals are more likely to be managed, as are deployments in constrained environments, therefore those requiring NB-IoT and LTE-M connectivity.

New Demand for Cross-Optimization

If the IoT market is moving towards becoming more about customized services, it equally requires that those services span a wider range of disciplines. In the section “The New IoT Market Landscape” below, we look at the diverse range of products and services that now comprise the IoT. What is apparent is that each element of IoT will benefit from being cross-optimized with others. Gone are the days when IoT adopters simply picked devices, networks, protocols, architectures and platforms independently with little consideration for the other elements.

In August 2021, Transforma Insights published a report, “What is the ‘Thin IoT’ stack and why do I need it?,” which describes an emerging norm within the development of IoT applications to make use of specific off-the-shelf technologies that have been created explicitly to be optimized for use in constrained environments, such as limited access to power, low bandwidth connectivity, and limited processing and memory. The elements of the Thin IoT stack cuts across devices, software and connectivity, including device components, operating system, connectivity platforms, networks, device management, eSIM, machine learning, and more. Figure 2 shows the five layers of the Thin IoT stack according to Transforma Insights.

Figure 2: The five layers of Thin IoT

[Source: Transforma Insights, 2021]

The technologies incorporated within the Thin IoT stack are major enablers of IoT, removing significant barriers to entry for developing solutions. There are a few further implications. Firstly, these technologies have tended to arise as standards, which are accessible to any solution provider or technology vendor. As such, these technology layers become less and less of a differentiator. Almost any vendor can integrate the functionality within these layers easily within their offerings, whether device management, eSIM or new access technologies. This increases the importance of the services and contextualization that are wrapped around the offering, as discussed in the previous section.

The second implication is that there is a greater requirement for all the constituent elements of an application to be optimized with each other, including hardware, connectivity, protocols, device management, data processing, networking and the actual application. This has particularly come to the fore with deployments in constrained environments because choices about one aspect of a deployment are likely to have implications for others. For instance, selecting a low-power wide-area technology such as NB-IoT would have implications for messaging protocols, favoring CoAP compared to MQTT.

This greater coordination might mean that more IoT building drifts towards systems integrators, but most of the mass IoT solutions market won’t be able to afford the associated cost. Alternatively, vendors of all IoT product and service types need a function (perhaps a “consulting-lite” capability) that works with the customer to optimize the solution or a new IoT solution vendor category is needed. Or vendors need an optimization function that curates a set of interoperable application elements and ensures that they work well with each other.

One positive result of this change is that it will help with one of the greatest headaches of deploying IoT: fault resolution. With disparate elements that aren’t optimized together, it’s often hard to avoid a blame game between vendors in the event of faults. An optimized solution and, ideally, a single point of contact (i.e., the vendor that acts as the optimizer) should reduce issues and result in swifter resolution. Having one point of accountability is becoming more important, particularly when resolving faults in critically interconnected elements.

Hardware and Connectivity Bundling Is on the Rise

One of the ways in which the requirement for cross-optimization is likely to manifest itself is in the increased bundling of cellular connectivity subscriptions with hardware in the form of modules and gateways.

In a recent study published by Transforma Insights, the Enterprise IoT Connectivity Survey, we found that 40% of enterprises, when asked what made their cellular connectivity provider stand out, quoted the ability to combine cellular connectivity with other products and services as a bundle. This was the second-highest response. Meanwhile, 75% said tighter hardware integration would be critical or very valuable.

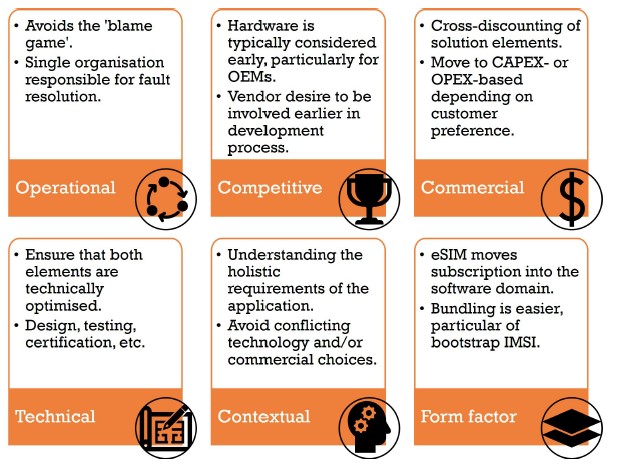

Transforma Insights has identified six ways connectivity and hardware make natural bedfellows, as seen in Figure 3.

Figure 3: Six IoT hardware and connectivity bundle types

[Source: Transforma Insights, 2023]

The first is operational. As discussed at the end of the previous section, there is a problem in IoT with providers of the various constituent parts of an application blaming each other in the event of a problem. Having one organization responsible for combined fault resolution helps remove some of the friction in deployments. This is particularly the case in complex multicountry deployments involving roaming, IMSI localization, different data sovereignty rules and so forth.

The second is competitive. There is an increasing recognition that participation in developing devices puts a provider in pole position for early consideration in the process of IoT solution or product development. The addition of connectivity and even software platforms will typically come later in the process. Adopters will think first of how they integrate connectivity in their offering before almost any other considerations, critical as it is to the form factor of the end device. Involvement in devices ensures that a vendor is considered earlier in the process, so providers of other aspects of IoT will benefit from adding a consistent device aspect to their offering.

The third aspect is commercial, whereby the vendor of either the connectivity or the hardware can offer more appealing commercial terms due to offering both elements. It is not inherently cheaper to provide both; however, the provider of both is better able to offer a broader set of commercial options, for instance, offering the hardware for free upfront and loading the cost into the connectivity recurring charges. Or vice versa, should the buyer prefer a CAPEX-based model to include prepaid connectivity for a particular duration or volume of data within the one-off hardware cost.

There are also, of course, technical advantages. The one provider can ensure that all the required design, testing and certification take account of both the device and connectivity.

The fifth category is contextual, incorporating all client requirements in the design. As one example, the provider can advise more intelligently about the choice of network technologies to ensure that not only will the options meet the technical specifications of the deployment but will also be compatible with the connectivity requirements based on countries or operators. A 2G or 3G solution may meet the technical needs of the solution, but many countries have already switched off those technologies and replacing them with emerging NB-IoT and LTE-M networks is patchy today.

There is a final category related to form factor. Specifically, the move to eSIM and iSIM is having an impact here. Historically, the management of the connectivity profile on the device was handled by switching in and out a physical SIM card. With the move to remote SIM provisioning (RSP), this is now a much more flexible exercise. Each device ships with embedded connectivity options, meaning that any hardware vendor needs to decide which ‘bootstrap’ identity the device might ship with. Like it or not, hardware vendors need to make choices about embedding connectivity, and connectivity vendors would be well advised to work with hardware makers to have their profiles ship with the devices.

Transforma Insights estimates that the number of IoT connections sold bundled with devices will more than triple from 30 million in 2022 to over 100 million in 2025, as illustrated in Figure 4.

Figure 4: Proportion of global cellular IoT shipments that are bundles of hardware and connectivity

[Source: Transforma Insights, 2023]

The New IoT Market Landscape

Underpinning the changes noted in the sections above is an ongoing change that we currently see in how the different roles and responsibilities in IoT are handled. The greater demand for managed services, the need for cross-optimization, and even trends like eSIM are stimulating a new structure for IoT.

The roles and responsibilities of vendors in IoT have always evolved. In the distant past, almost all IoT deployments involved a heavy-lifting process of enterprises, OEMs or solution providers piecing together hardware and software to get a solution off the ground. Since then, new technologies have emerged that are more optimized for IoT and simplify the process of developing products and solutions. With that change, we saw the emergence of specialist IoT hardware, connectivity, software and solutions vendors.

Today, further evolution is underway in the IoT landscape, driven by trends like network virtualization, cloud and edge computing, and evolving regulatory and security requirements. Specifically, Transforma Insights has identified the emergence of a set of new service domains separate from the more traditional infrastructure domains that were preeminent in IoT until now. The split of the IoT landscape between these two types of domains will have significant implications for how the market evolves.

The old established infrastructure domains are associated with the physical elements of the IoT solution (i.e., device, network, data center and enterprise systems). What has changed recently is that there is also a more well-defined and discrete set of service domains focused on flexible software aspects of the infrastructure domains and other business services.

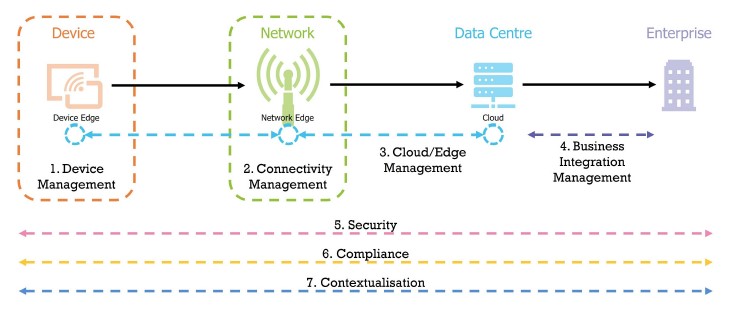

The service domains comprise:

1. Device Management

At its most basic, this involves the traditional device management functions of provisioning, configuration, authentication, monitoring, controlling and updating devices deployed in the field. In addition, it involves ensuring device management is done properly and even managing the inventory of devices.

2. Connectivity Management

This entails providing connectivity services, including connectivity management platform, core network, subscription management and ultimately management of multicountry network access, independent of operating a radio access network.

3. Cloud and Edge Management

Software capabilities related to delivering data to the cloud (or edge) via cloud connectors and orchestrating where IoT data storage and processing is occurring.

4. Business Integration Management

Managing how IoT data is delivered into enterprise back-office systems, such as ERP and CRM.

5. Security

Comprises security components, such as device IMEI locking, IPSec VPNs and IoT SAFE, as well as end-to-end security and policy management.

6. Compliance

Ensuring enterprises comply with the growing number of IoT-related regulations through a compliance-as-a-service for regulations and relevant partner policies.

7. Contextualization

IoT vendors need to understand the pain points of enterprises and be able to deliver services that specifically help that client with their deployment. That’s contextualization.

Figure 5: The seven service domains of IoT

[Source: Transforma Insights, 2023]

To look in more detail at one example, in the connectivity management domain, one of the key technology trends is the concept of virtualization, involving the separation of the software/control layer of the network from the physical infrastructure. One way this manifests is through the growing common practice of deploying a virtual core network dedicated to IoT. A packet gateway can be deployed in a data center to manage device networking, data routing, policy management and other functions. With this new software- and cloud-based approach, it becomes much easier for any number of connectivity providers to offer a richer set of connectivity services. The role of running a mobile network is being removed from providing a sophisticated set of connectivity services.

The move into the service domains has significant implications for the greater pivot towards managed services, cross-optimization and bundling. The service domains are more open to greater competition from different vendors, meaning there will likely be vendors able to span multiple domains with bundled offers. To add differentiation to such offerings, they will also need to handle cross-optimization and offer them as managed services.

The other domain that has the most significant ramifications for the delivery of IoT connectivity is contextualization. Whatever aspect of IoT you look at, there tend to be many different vendors that, on paper, have comparable functionality. However, there will be a world of difference between them in terms of the heritage of addressing customer needs and understanding the pain points and specific requirements an enterprise might have. In IoT, many companies can support enterprise IoT deployments, but far fewer have earned their stripes delivering to large numbers of clients in the real world.

Choosing an IoT Connectivity Provider in the New Environment

One of the main questions that enterprise IoT adopters ask Transforma Insights is, “Which vendor should I select and why?” The answer will inevitably come down to the buyer’s specific deployment parameters and sensitivities. However, we can offer a few pointers on selecting a vendor in the newly evolved IoT taxonomy, with growing capabilities in managed services and the need for cross-optimization and bundling.

- Look for a vendor that will provide the appropriate levels of support and management. No longer should buying IoT project elements be a simple one-off transaction. Enterprises should look for vendors willing and able to act as long-term strategic partners that help with planning, deployment and delivery.

- Look for a vendor with experience that matches your needs. There are many seemingly interchangeable vendors in the IoT space with comparable offerings. Look for experience working in your vertical sector or with other deployment parameters.

- Get someone who can optimize the different solution elements. Very few enterprises are in a position to pull together all the various aspects of an IoT solution and ensure they work optimally with each other. That’s something for your vendor to handle. This includes things like cloud integration and application logic.

- Prioritise security and compliance. Two service domains in the new IoT taxonomy discussed above are security and compliance. Enterprises cannot be expected to understand the intricacies of either and need a vendor that can help to navigate both, a task that will inevitably need to be done in the context of other technical and commercial choices (e.g., which countries are you deploying in, what is the architecture, what technologies are you using, etc.).

- Do your counterparty risk analysis. Any company deploying IoT is likely seeking suppliers for a multi-year (if not multidecade) relationship. In many cases, this is for a mission-critical application. In these circumstances, enterprises must be sure that their chosen vendor will be around for the long haul. There have been some recent high-profile examples of vendors exiting the IoT space, either shutting down products or running into financial challenges. Look for vendors with sufficient scale and proven commitment to the IoT space.

About Telit Cinterion

Telit Cinterion is a global enabler of the intelligent edge and the largest Western provider and pioneer in IoT innovation. We build ready-to-launch IoT solutions with modules, managed connectivity services and platforms.

Telit Cinterion provides advanced IoT connectivity services for deployments at any scale. Offerings include global coverage on one SIM and embedded connectivity within the module. The company’s enhanced embedded Universal Integrated Circuit Card (eUICC) and over-the-air capabilities empower customers with flexibility. They can work with mobile network operators (MNOs) that provide the best options for coverage, technology or costs.

Unique Advantages

Customers get:

- A flexible commercial offering with global coverage. We provide customized connectivity solutions, including:

- Prepaid and postpaid plans

- Multi-IMSI and multiprofile connectivity on one SIM across many networks

- Early-stage advantage. Our secure, award-winning modules provide an early-stage advantage with Telit Cinterion connectivity plans.

- A proven industry leader and trusted advisor. We craft solutions that abstract IoT complexity with a full review of customers’ projects and specific use cases.

- The most comprehensive connectivity management platform. Our award-winning connectivity management platform was designed in-house from the ground up to address IoT challenges. It provides customers will full device visibility from one intuitive dashboard.

- World-class 24/7 customer service with regional presence and expertise. We provide services with harmonized time zones and language support. Our customer service representatives have in-depth knowledge of network operations worldwide.

About Transforma Insights

Transforma Insights is a technology industry analyst firm focused on the impact of emerging technologies and the associated technical and commercial best practices.

We help technology adopters understand the opportunities associated with new technologies, particularly the Internet of Things, but also in artificial intelligence, distributed ledger, edge computing and others under the umbrella of digital transformation.

We help technology vendors understand the changing market dynamics and the associated market opportunity.