Executive Summary

5G is here, opening new opportunities for the Internet of Things (IoT). The potential market is sizeable and consequential, with plenty of room for established companies and new entrants to build products, integrate solutions and create apps based on the technology.

5G is enticing for developers because it brings wireline performance capabilities. Like all things cellular, it is intended to become ubiquitous and serve a wide range of use cases and vertical markets. The technology is more complex than 4G because it uses spectrum, radio access and networking technologies in ways that were not viable for cellular before. It also allows more variability in how it is configured by mobile network operators (MNOs) worldwide.

The technology’s complexity and versatility pose design challenges for device-side OEMs, whether they are experienced in cellular designs or new to the industry and whether they are building solutions inhouse or outsourcing hardware development to manufacturing partners. While these OEMs must understand the complexities, they should not let this deter them from pursuing 5G projects. Enabling technologies like cellular has always been complex and is likely to become more challenging as we go forward into 5G’s maturity and beyond.

This paper’s purpose is to build awareness of the complexities and provide guidance manufacturers can use to ensure their designs and selected modules will serve their intended products and business objectives. The paper summarizes 5G technologies’ critical features, new possibilities with the expanded use of spectrum, main components of new advanced antenna systems and end-to-end communications considerations for product designs. It will also review how to evaluate leading vendors, the importance of a good business model and go-to-market strategy, and the role partners can play in laying the foundation for success.

5G Networks Are Up, Running and Ready for IoT

5G is now commercialized globally, with 135 operators having launched networks in 52 markets as of year-end 2020, according to GSMA Intelligence. While rollouts will continue for many more years, today’s deployments already provide a strong foundation OEMs need to start deploying new generations of IoT products and services tailored to local, regional or global markets. The business opportunity for OEMs is real and consequential. GSMA forecasts that IoT will be an “integral part of the 5G era,” with the number of IoT connections expected to double by 2025 (to 24.6 billion) and IoT revenues tripling (to $1.1 trillion).

$906 billion in IoT revenue by 2025, with value continuing to move up the stack to platforms

5G is a stimulating environment for IoT because it brings wireline performance capabilities to cellular for the first time. 5G also offers the flexibility to support a wide range of usage categories, including enhanced mobile broadband (eMBB), ultra-reliable low-latency communications (URLLC), and massive deployments of low-power, low-data IoT devices called massive machine-type communications (mMTC).

This versatility will enable OEMs to build IoT products for applications they could not envision before. 5G-enabled fixed wireless customer premises equipment (CPE), for example, will bring the internet to office buildings with enough capacity and bandwidth to support high-speed downlink and uplinks for computers, security cameras and user devices.

Industry 4.0 applications such as untethered, autonomous manufacturing robots will have the bandwidth and ultra-low latency their time-sensitive networks (TSN) and artificial intelligence (AI) software require to guide operations and perform tasks under real-time control.

Get Your Manufacturing Plant IIoT-Ready with Telit deviceWISE®

In the media industry, film crews on location will be able to broadcast live high-definition video directly from 5G-connected video cameras, eliminating the need for satellite trucks and associated crews. 5G will also bring broadband services to rural areas, support autonomous cars, connect unmanned flying vehicles (UAVs) for utility and agriculture applications, and provide broadband internet access to homes and schools that cannot be reached by cable.

5G Learning Curves Impact All OEMs

While 5G opens business opportunities for IoT, the technology is more complex than previous cellular standards and comes with a steep learning curve for OEMs.

5G is challenging because it is not an incremental, evolutionary upgrade to 4G. Much of the 5G standard is new, including a “new radio” access technology (NR), which uses spectrum and antenna systems in new ways. 5G also uses a new core network, cloud-native architecture, edge computing, security-by-design and other features and approaches that enable the end-to-end services5G use cases require. Like all good standards, it is also flexible. It ensures MNOs implement the 5G specification consistently to provide interoperability and drive economies of scale. Still, it gives MNOs leeway in how they configure their systems to differentiate their services while meeting requirements specific to continents, regions, countries or markets.

As a result, even experienced manufacturers knowledgeable about 5G will find they are entering new development territory. There is no cookie-cutter approach for advancing 4G-based designs to 5G, and OEMs must make sure they understand the differences (e.g., power consumption and thermal characteristics) before planning 5G projects. They will not be able to swap one technology for the other, for example, and they will need to evaluate how much of their previous designs they can reuse for any given product or market. They should also expect more design iterations during the development life cycle.

Manufacturers that are both seasoned and new to cellular must tap the expertise of one or more solution chain partners to help guide their work, manage costs and speed time to market with their designs. OEMs with backgrounds in wireline technologies can leverage that experience to envision new designs for the cellular IoT market. Regardless of experience, any manufacturer pioneering new types of products or product categories for 5G IoT will need to create business models for their solutions.

New Spectrum Possibilities and Advanced Antenna Systems

Cellular standards have always allowed operation in various spectrum bands to meet global market needs, but 5G takes this flexibility to a new level by allowing operation in more band types and combinations. OEMs pursuing 5G designs must understand these options and the implications on the designs, markets, use cases and business models they are considering.

Spectrum

5G spectrum ranges from sub-6 GHz bands to 27 GHz and higher millimeter wave (mmWave) bands. In the sub-6 GHz ranges, services will operate in low-band (below 1 GHz), mid-band (1 to3.5 GHz) and high-band (3.5-6 GHz) spectrum. Services in sub-6 GHz bands should support data speeds ranging from 100 Mbps to 1 Gbps, depending on the spectrum band and implementation. The mmWave category allows operation in bands that have never been used for cellular before. The mmWave options provide dramatic improvements in bandwidth to support tens of Gbps data speeds and ultralow latency. Still, connections are short-range, operate almost as line-of-sight and extremely sensitive to rain, reflections and other environmental conditions. Because of these sensitivities, mmWave IoT designs are harder to engineer and certify. These devices will be used primarily in “giga-zones” like airports, stadiums, shopping malls, manufacturing facilities, warehouses and other locations where conditions can be carefully controlled.

Carrier Aggregation and Dual Connectivity

Carrier aggregation and dual connectivity are crucial in 5G because they enable MNOs to combine radio channels to bolster capacity and increase data speeds. While carrier aggregation is used with 4G, 5G combines spectrum from a broader selection of bands and even tiny segments of spectrum, yielding dozens of combinations that weren’t possible before. 5G also introduces a new concept called dual connectivity. Both radios, the 4G LTE radio and the 5G NR radio within the same modem, can operate simultaneously and aggregate their respective data rates to yield much higher overall data rates.

Configuring IoT designs to support abroad combination of carrier aggregation and dual connectivity possibilities will influence the development time frame and costs. Manufacturers must know which band combinations are required for operation on a particular network and make sure their designs can aggregate those bands to deliver the bandwidth and uplink speeds their products need.

Advanced Antenna Systems

5G advances the use of multiple-input multiple-output (MIMO) antenna schemes to increase spectral efficiency, achieve high uplink and downlink data speeds, improve signal reliability, and mitigate the sensitivity of signals delivered, particularly over mmWave spectrum. These benefits are achieved by spatial diversity — physically separating the antennas in a device and enabling the antennas to receive redundant data streams. MIMO also uses spatial multiplexing, which carries data on different antennas to improve capacity and data rates. Beamforming and beam tracking are other advanced techniques to steer radio beams’ energy toward specific directions to focus the energy on the receiver, thus improving the radio performance in massive MIMO implementations.

Power Classification

Devices operate within specific power classifications based on the radiated power the RF components transmit. These classifications govern requirements for mounting parts in a design and how an end-product can be used in the market. 5G mmWave systems, for example, can operate at high power, and that power classification will require high outdoor mounting and operation at designated distances from the human body. These devices will be deployed on the roof of automobiles or exterior of homes and buildings and require professional installation when not factory assembled into fixed and mobile platforms like cars, trucks and airplanes. 5G antennas that operate in low-power mmWave or sub-6 GHz frequencies will have power classifications that perform like current cellular antenna systems and are safe for consumer installation and use across all power levels. Typical devices include handsets, tablets, laptop computers, routers, gateways, cameras and surveillance devices.

Thermal Management

Because 5G devices can operate at high frequencies and high power and achieve very high data rates, they require careful heat dissipation engineering to prevent overheating and associated adverse impacts on device performance and reliability. OEMs need to consider thermal characteristics and mitigation techniques when choosing data cards for 5G IoT designs, particularly for those that will operate for long periods or constantly in high power transmit modes, such as enterprise, industrial and manufacturing robot routers, etc.

End-to-End Communications Considerations and Requirements

5G devices are part of an end-to-end communication solution, and developers must consider the overall context in which their products will use hardware, software and the network.

Network Architecture Options

The 5G standard gives MNOs two options for deploying the network, and each uses distinct connectivity techniques.

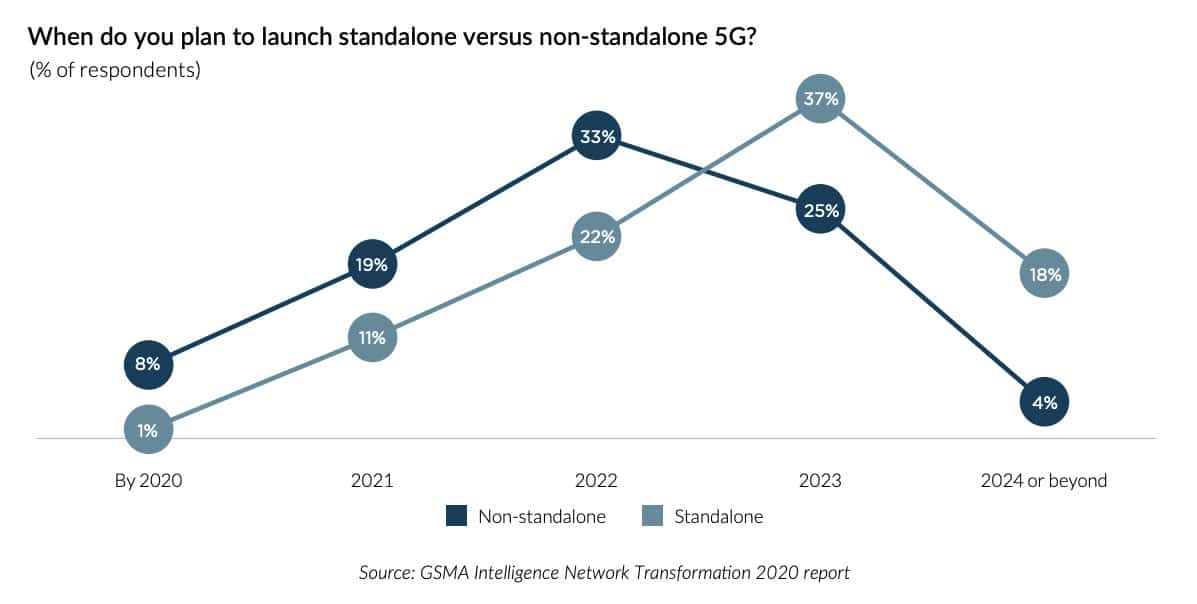

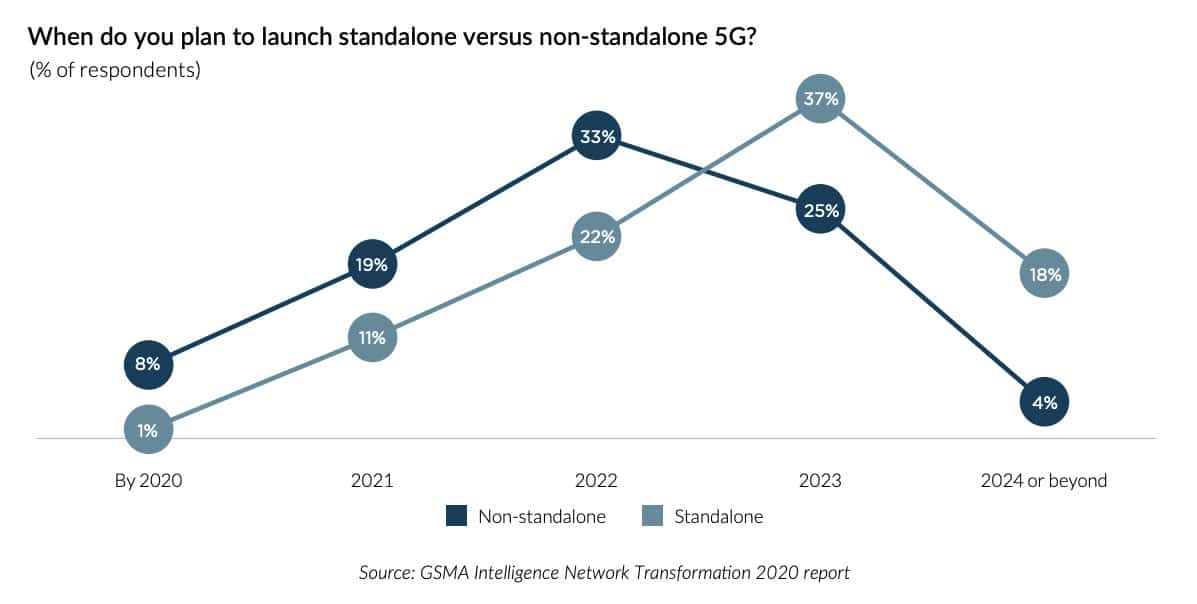

Non-standalone mode (NSA), an architecture for MNOs transitioning to 5G, operates 5G speeds on the MNO’s slightly updated LTE infrastructure. This hybrid technology capability described above as dual connectivity enables 5G devices to simultaneously access both 5G and LTE while boosting data speeds for 3GPP Release (Rel) 15-capable mobile devices. Dynamic spectrum sharing (DSS) is another technique that allows LTE and 5G to share the MNO’s spectrum dynamically across mobile devices, balancing the load between the two as needed in real time.

OEMs building products for NSA 5G networks must ensure the modules they employ can support these features on paper and in real-world applications or face serious risk of suffering of service unavailability for their devices. 5G networks built-in standalone (SA) mode are full-fledged 5G networks from end to end. These networks use the new radio, dedicated spectrum, a cloud-native core network and edge computing to optimize capacity and achieve the high data speeds and ultralow latency the most demanding IoT use cases will require. OEMs planning products for these networks should familiarize themselves with 3GPP Rel 16 and 17 standards to glean insights into benefits from 5G SA, including network slicing, URLLC, sidelink, enhanced positioning, Low Mobility Large Cell (LMLC) and others.

Embedded SIMs for 5G

SIM cards for 5G IoT devices can be permanently embedded in modules similar to standard practice to date, soldered to the printed circuit board (PCB). As in previous generations, 5G embedded SIMs require remote activation by the carrier, but they make it easier to deploy products for use in multiple geographies. Embedded SIMs are more secure and reliable because they are tamper-proof and more resilient to weather and rugged usage conditions.

Managing Devices and Cellular Connectivity

OEMs will find that onboarding devices, managing cellular connections and providing ongoing support for field-deployed devices are different efforts with 5G than earlier cellular technologies. The differences stem from the varying approaches MNOs will use to deploy networks and the cloud-native architecture of 5G. Whereas onboarding of devices and service provisioning become simpler than previous technologies, subscription options, plan packaging and other new service parameters that weren’t available before (e.g., hybrid public-private networking operations) will need to be considered.

Comprehensive device management platforms can provide embedded module software and dashboard applications to simplify IoT connection logistics and processes dramatically. Be sure to carefully evaluate the vendors’ management platform options and have a solution in place at the outset to manage all devices from a centralized interface.

Because it is easier to integrate management solution before rather than after deployment, this decision should not be postponed. Be cognizant of the “single panes of glass” proliferation threat across so many individual management areas that result in no net benefit to you.

Compliance and Certification

As always, OEMs bringing cellular designs to market must receive certification from global standards organizations, regulators and carrier networks. A module provider should test and certify its solutions to support worldwide operation and ensure its devices will perform as expected, eliminating — as much as regulations allow — the time and expense for OEMs to go through these processes. 5G introduces some new considerations, however, that OEMs must keep in mind.

In the United States, the Federal Communications Commission (FCC) has implemented new certification rules for mmWave-based 5G products because mmWave will require integrating active antennas and modules to optimize performance. As a result, for 5G mmWave designs, the FCC is requiring certification of modules and antennas together and issuing FCC IDs at the end-product level. The new rule does not apply to products that use sub-6 GHz frequencies. In these cases, as before, an OEM can include a module’s FCC ID when certifying a finished product, as long as the end product integrates the module appropriately.

Vertical industries often have a say in how companies use networks. OEMs will also need to ensure IoT devices comply with special regulatory requirements established by health care, financial services, the military and other more mission-critical segments. In some cases, regulations might apply specifically to the cellular module; in others, the regulations might apply from a few to all the solution stack layers. OEMs must anticipate these requirements and build their products accordingly to ensure compliance.

Private networks will also authorize how devices access their services. 5G is driving an increased interest in private networks (private 5G) because the technology gives organizations the ability to provision coverage, capacity, service quality, data speed, cybersecurity and other features to serve their particular use cases at specific locations. The data exchanged over the cellular 5G network stays entirely on the premises, lowering latency and strengthening security. Organizations expected to adopt this approach include factories and warehouses, airports and seaports, shopping malls, ore mines, and others. OEMs planning to serve these markets will need to meet the requirements and business models specific to each case.

Crafting a Business Model and Go-to-Market Strategy

Crafting a business model and go-to-market strategy are essential steps in the development process. It’s vital to get these right to avoid mistakes, control costs and accelerate time to market with high-quality, competitive products.

OEMs tend to go about this from one of two starting points. Some have decided to go to market with a particular solution and business model, and they have the know-how to design, build and deploy the product. However, they don’t understand 5G technology and how to use it to best support their strategy. Conversely, some have a good understanding of 5G, but they haven’t crafted a business model and don’t have adequate knowledge of the manufacturing landscape. The following guidance will help both groups.

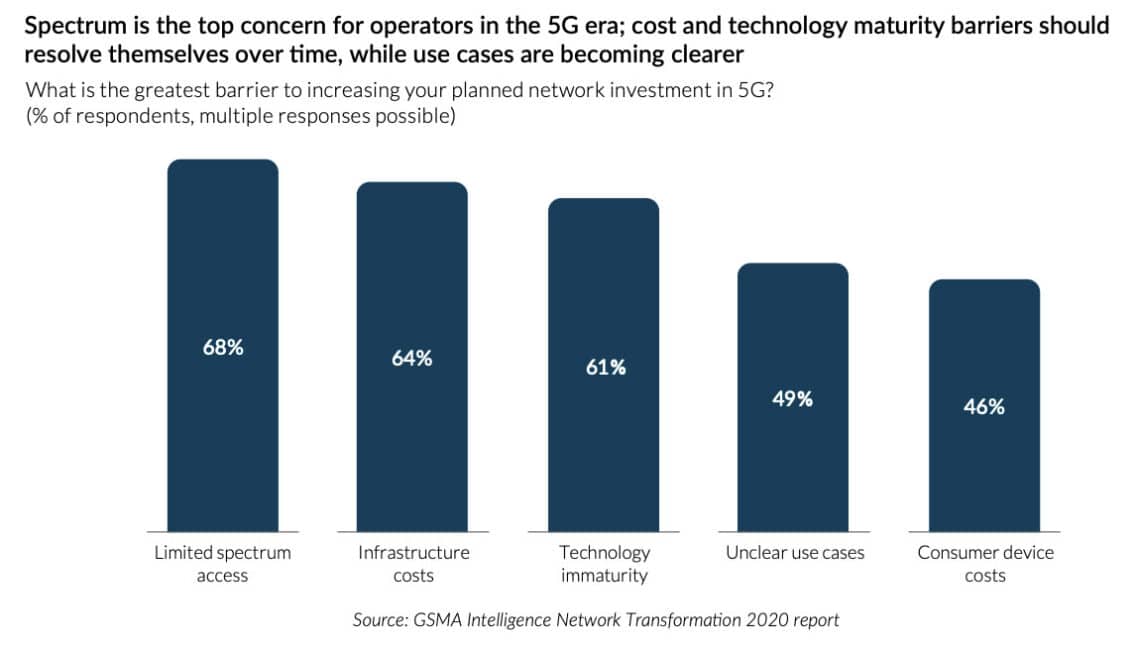

Cost

The market for 5G IoT services is vast and growing, but it is still a new technology. Early adopters should expect sticker shock when it comes to costs. 5G silicon components have not yet achieved the economies of scale from pervasive deployments. The complex parts can be difficult to install, and more competition is needed among silicon providers to bring down prices. As a result, 5G product development can currently require double and even triple the 4G designs’ investment. The costs will influence an OEM’s technology choices and business model and require a thorough understanding of the target market and the prices it will bear. For example, firms targeting consumers may find it challenging to meet consumer-friendly price points until 5G matures more. In contrast, providers of enterprise-grade industrial robots or medical imaging equipment are quite tolerant of the 5G cost premium.

Build vs. Buy

Deciding whether to build your solution or acquire it from a vendor is significantly different with 5G than 4G.

With 4G IoT, an OEM can buy and self-brand a precertified white-label solution and price the product accordingly to recover its costs. Alternatively, an OEM can build its design with an embedded module and handle its certifications, recovering component and development costs with sales volumes. Another option is to create a product with a socket modem — a plug-and-play, carrier-certified modem that is easy to install in a device. The socket modem option is suitable for small firms that don’t have engineering expertise or are looking at very small deployment volumes. Component cost is higher but offset by the savings gained from avoided development, design and certification costs.

With 5G, socket modems are not an option, and OEMs will need to build embedded designs. Socket modems are also incompatible with mmWave designs, given the complexities of mmWave antenna systems, the integration of the antenna and module, and in the United States, the new FCC rules requiring product-level certification. Ensure that the selected 5G module provider can make mmWave work easier by packaging subcomponents into an “integrated antenna module” that delivers full-spec performance and can be deployed as it is by the OEM.

Selecting a Manufacturing Partner

OEMs must decide what type of manufacturing services to use and whether to use their manufacturing partner to build all or part of a product. Developers should apply due diligence when selecting a partner: Make sure the partner has experience working with 5G, and be on the lookout for design or contractual restrictions that might impact the product or go-to-market strategy.

Contract manufacturers generally assemble the product using components and specifications the OEM provides. Original device manufacturers (ODMs) often develop reference designs for use by multiple companies. Electronics manufacturing services (EMS) firms will engineer and build a custom design.

However, OEMs should not feel constrained by any manufacturing category as some partners are willing to offer a combination of services. As the 5G IoT market builds and multiple OEMs seek similar products, it’s also likely that developers will be willing to share a design to reduce costs. OEMs adopting this approach will need to decide which parts of their intellectual property they are determined to own or willing to relinquish. They should also make sure any exclusivity terms in the contract are to their advantage, not their detriment.

Supply Chain Considerations

The complexity of 5G technologies, combined with their expected application for a broad range of use cases and industries, means that OEMs will face an expanding universe of vendors for their designs. The multitude of vendor choices will make it more difficult to find and vet sources.

Asking the right questions of all potential partners can help guide good decision-making and avoid unexpected roadblocks during development. For example, it’s essential to ask vendors what supply chains they are qualified in at the outset. Some supply chains are complex, some are stringent, and some have testing standards of their own. For instance, the automotive industry, which is perhaps the most rigorous supply chain, imposes strict quality and testing requirements on devices deployed in vehicles. Oil refineries and mines have requirements for use in explosive environments. If a vendor can’t accommodate the relevant requirements, look elsewhere for a partner.

The history and traceability of components like a 5G module that go into an assembly are also important. For example, some ecosystems can demand extensive documentation for all or some of the parts used in a device. If a 5G card deployed in a medical device is faulty and recalled, the OEM and others in the supply chain must trace the failure to the component level.

The country of origin for components also matters, particularly with 5G technology. Some markets, such as the military and public sector agencies and some countries, impose restrictions on equipment that is imported or contains imported key 5G components from specific regions. Be aware of these possibilities and consider origin restrictions for launch markets and potential expansion markets.

Vendor and Partner Support

Regardless of an OEM’s expertise and experience, it will likely need some level of support during the development life cycle. It’s not unusual for a company to seek support in various ecosystems, including solution design, antennas and connectivity, power supply design, cybersecurity, software platform development, and the interaction of software, firmware and hardware for different layers of the stack. A company building a private network will also need a partner to provide the cloud-based 5G core network.

Regardless of the type of support, vendors and partners should have deep, demonstrated expertise in 5G and support teams as close to your region, time zone and language as possible that are accessible, reliable and able to keep pace with aggressive development time frames. While web portals and online forums can provide a measure of support, these channels can’t replace dedicated support teams and personnel needed for complex strategic projects like 5G.

Informed 5G Decisions Are the Foundation of Success

5G is creating new markets and opportunities for IoT, but the technology’s complexity introduces new cellular design and development challenges that OEMs did not face before. Whether an OEM has experience in cellular or is new to the industry, those seeking to enter IoT markets with 5G will need to take time to understand the technology, its requirements for device designs and the overall context in which it uses a network end-to-end.

Companies must also tailor their designs for the use case, industry, geography and mobile network they will use. The challenges can seem intimidating, but they are solvable. Success can be achieved with a business model based on technology requirements, cost, certification, manufacturing and supply chain considerations. Keep in mind that partnerships matter with 5G IoT, perhaps more so than generations of cellular that came before.

Companies will do well if they draw support from their ecosystems at the inception of their projects and keep that support channel well-orchestrated throughout the development life cycle.