Executive Summary

As Internet of Things (IoT) deployments surge, Mobile World Live conducted an online survey of 202 people in the mobile industry on behalf of Telit to research the future of IoT edge technology, which shifts control, visibility and processing to the edge of the information path. The survey yielded insights into industry awareness of the technology and the expected pace of uptake, as well as what issues need to be resolved to facilitate widespread adoption and what benefits companies expect to reap from implementation.

Key Findings

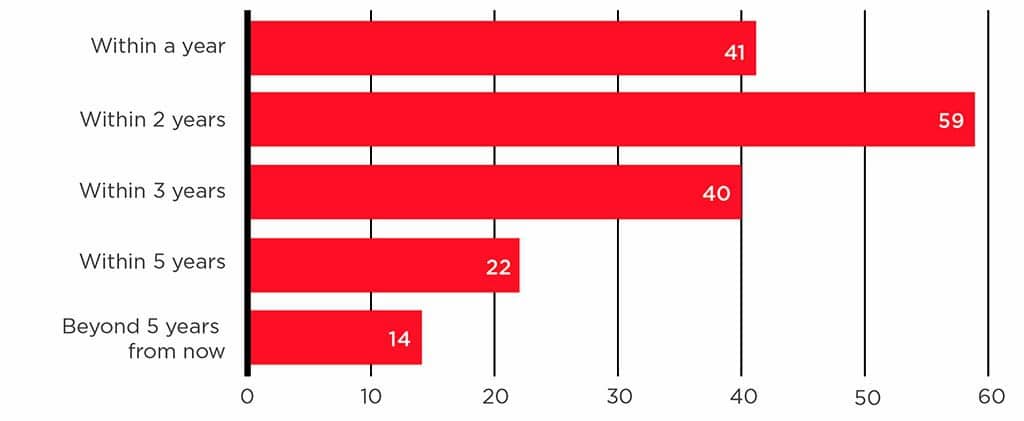

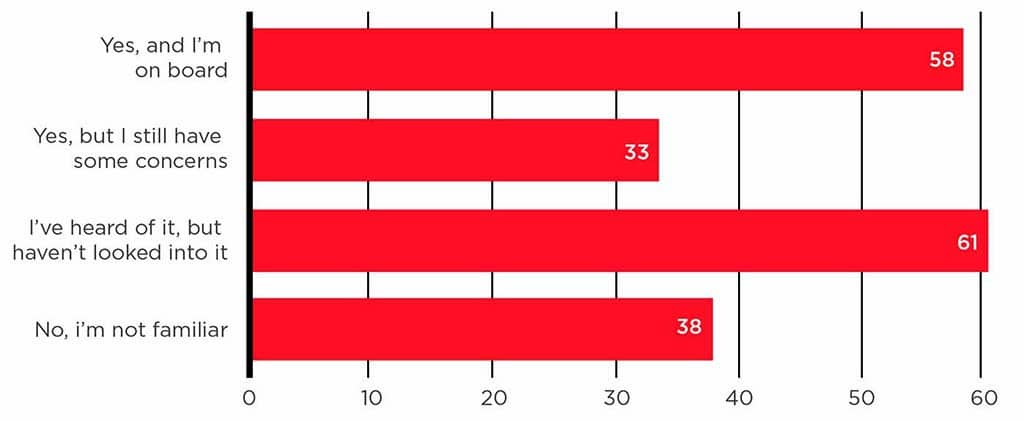

Knowledge gap — Nearly 80% of respondents said they plan to deploy IoT edge capabilities within the next three years. However, more needs to be done to acquaint companies with the technology. Around a third (32%) of respondents said they had heard of IoT edge but hadn’t explored it further, while another 20% said they weren’t familiar with it at all.

Putting IoT edge to work — The survey highlighted areas where respondents see value in the application of IoT edge technology, particularly as a solution to reduce cost and increase efficiency (27%), enable new use cases that can’t be served presently (25%) and offer real-time, actionable insights (24%).

Respondents tipped the smart cities/smart buildings (27%), consumer/smart home (25%) and automotive (16%) segments. According to respondents, the top industry beneficiaries of IoT edge include smart cities/smart buildings (27%), consumer/smart home (25%) and automotive (16%).

Focus on security — However, respondents also pinpointed several issues which need to be addressed to facilitate IoT edge adoption, including reliability (12%) and cost (11%). Security also emerged as a prominent concern and top priority among respondents. More than half (51%) flagged it as the number one issue which needs to be resolved to facilitate adoption, and 54% listed integrated security as their top requirement from an IoT edge solution.

Introduction and Methodology

Though nearly non-existent just a few years ago, the IoT market is in the midst of an exponential growth spurt. GSMA Intelligence noted there were 6.3 billion IoT connections in 2016, a figure it predicted will skyrocket to 25 billion by 20251.

With more devices on the network, centralized processing becomes more cumbersome. However, IoT edge technology uses capable devices and gateways to push functionality, including device integration and management, data collection and processing, and analytics, to the outer reaches of the network.2, 3 Moving storage and processing of data to the edge increases device reliability and reduces the need for costly data transport to a central processing center.

This report assesses industry familiarity with and interest in this technology, as well as expected deployment timelines, applications and benefits. It also identifies key pain points the industry would like to be addressed before the technology proliferates.

To inform the analysis, the paper draws on an online survey of 202 people in the mobile industry conducted by Mobile World Live on behalf of Telit. Some 20% of the respondents were from a hardware vendor, 14% were from a software vendor, 9% were from a tier-one telecoms operator, 5% were from a tier two telecoms operator and 3% were from a mobile virtual network operator. The remaining 48% of respondents were from other participants within the mobile ecosystem.

The main group of respondents (48%) were from organizations with their headquarters in Europe. An additional 26% were from North America, 9% from East Asia, 5% from Africa, 4% from South East Asia, 3% from South America and 2% from South East Asia.

What Is IoT Edge

Nearly a quarter (23%) of survey respondents said they would like to deploy IoT edge technology within a year, and the vast majority (nearly 80%) indicated they’d like to move ahead with deployments within three years. A significant number of respondents also revealed they lack a real understanding of what IoT edge encompasses and need more information: 32% said they had heard of the technology but hadn’t looked into it, and another 20% said they weren’t familiar with it at all.

So What Is IoT Edge?

As the wireless industry moves toward 5G, mobile providers are gravitating toward distributed architectures that can push computing tasks normally processed in a centralized location or the cloud to the edge of the network.

IoT edge technology applies a similar principle but to the information, relying on connected devices to move various functionalities closer to the points of the network where data is generated4. Using an IoT edge setup, device integration and management, data processing and analytics, and decision-making can all be handled at or very near the information-generating endpoints.

However, technical hurdles have historically stood in the way of IoT edge deployments.

The shift to a true IoT edge calls for connectivity to be embedded directly into devices themselves rather than an external gateway. Until now, fragmentation has plagued the market, forcing device manufacturers to choose from a variety of short-range connectivity technologies, such as Bluetooth® wireless technology, LoRa and Zigbee, to allow their devices to communicate with an external gateway.

Cellular IoT technologies, including LTE-M and narrowband IoT (NB-IoT), now offer the ability for devices large and small to speak the same language and connect directly to the mobile IoT network. These technologies also provide broader coverage areas than short-range technologies and greater support for mobility applications. LTE-M even offers support for Voice over LTE (VoLTE) service.

Operators around the globe have been quick to recognize the mobile IoT opportunity: in Europe, Vodafone and Deutsche Telekom both announced plans to launch LTE-M in addition to their existing NB-IoT offerings; Australian mobile operator Telstra deployed both LTE-M and NB-IoT; China Mobile pressed toward a nationwide NB-IoT network; and US operators AT&T and Verizon led with LTE-M deployments with plans to deploy NB-IoT in future, while T-Mobile U.S. went straight for NB-IoT.

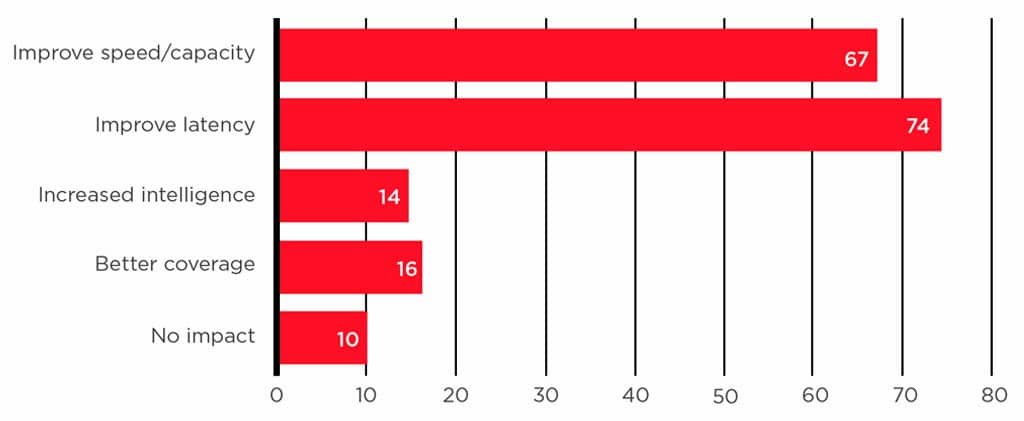

5G is expected to be an even greater catalyst for IoT growth, ensuring support for existing deployments through the integration of both LTE-M and NB-IoT5 in the 3GPP standards and enabling massive IoT scale with support for 100 times the number of connected devices per unit area compared to 4G. The next-generation technology is also expected to reduce latency and add capacity, providing further support for IoT networks.

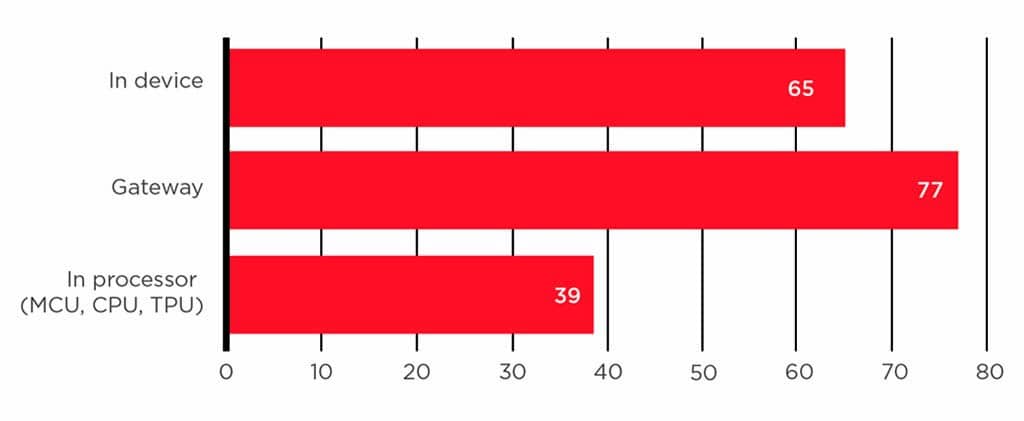

With the pieces in place to push functionality out to devices using cellular technology, attitudes about where the IoT edge should reside are changing. While around 43% of survey respondents said the IoT edge should extend only to a gateway, nearly 58% favored an IoT edge that resides in either the device or its processor.

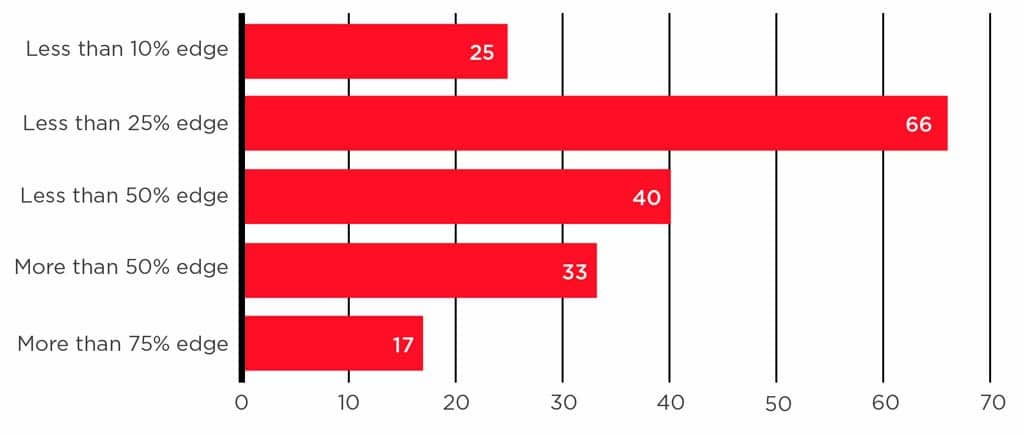

It seems the industry believes it will take time for the migration of functionality to occur. Around 72% of survey respondents said less than half of analysis and processing will occur at the edge five years from now. Only 27% expected more than half of such computing to shift from the cloud and core to the edge within five years’ time.

Why IoT Edge

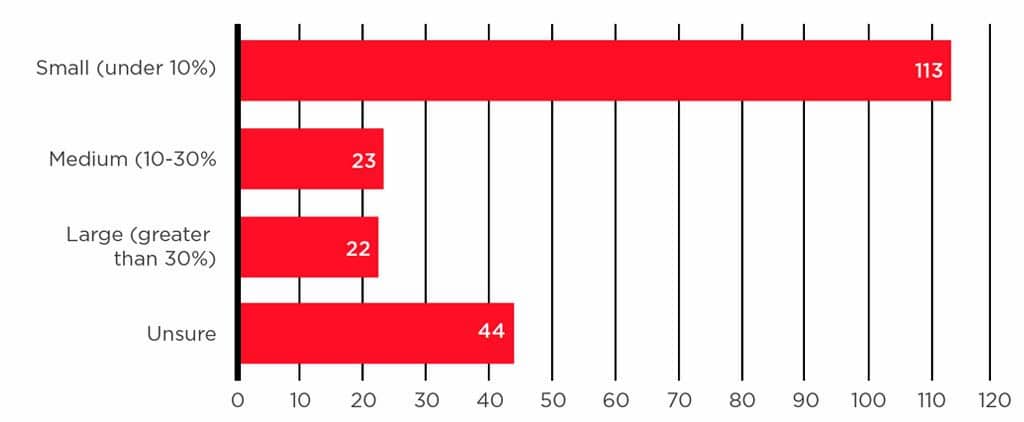

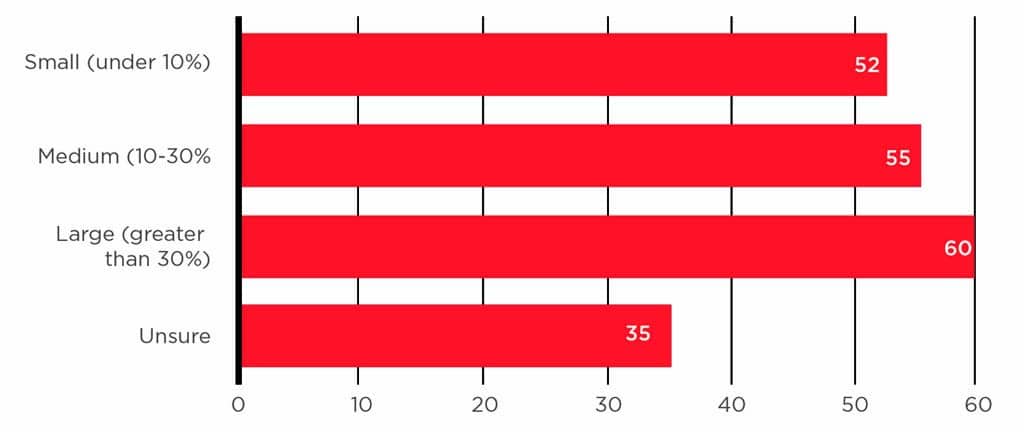

The vast majority of respondents (56%) said less than 10% of their company’s revenue is generated by IoT or machine-to-machine (M2M) today, though 11% said the segment made up between 10% and 30% of revenues and another 11% said IoT made up more than 30% of revenue. That mix is expected to change significantly in the coming years.

Around 30% of respondents predicted IoT and M2M will account for more than 30% of their company revenue by 2023, while another 27% said the segment will account for between 10% and 30% of company revenue in the same timeframe. Only 26% of respondents anticipated IoT would still make up less than 10% of their company revenue by 2023.

As companies grow IoT deployments, IoT edge technology can be used to improve reliability, reduce latency and help cut down on data transport costs. The large proportion of respondents highlighted above who said they are planning to deploy the technology within the next three years indicates companies are keen to reap such rewards, and the survey offered a closer look at what benefits they expect from IoT edge implementations.

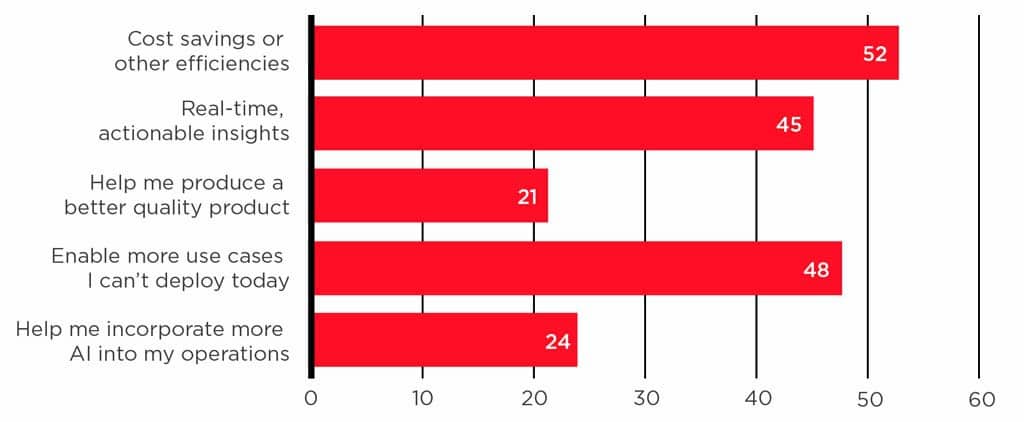

Cost savings and other efficiencies were tipped as the primary driver of IoT edge adoption by 27% of respondents. Another quarter of respondents said the technology will provide value by enabling new use cases that they cannot offer today, and nearly 24% indicated they were interested in IoT edge for the real-time insights it can offer. An additional 13% believe the technology will help them incorporate more artificial intelligence (AI) into their operations while 11% said it would help them produce a better quality product.

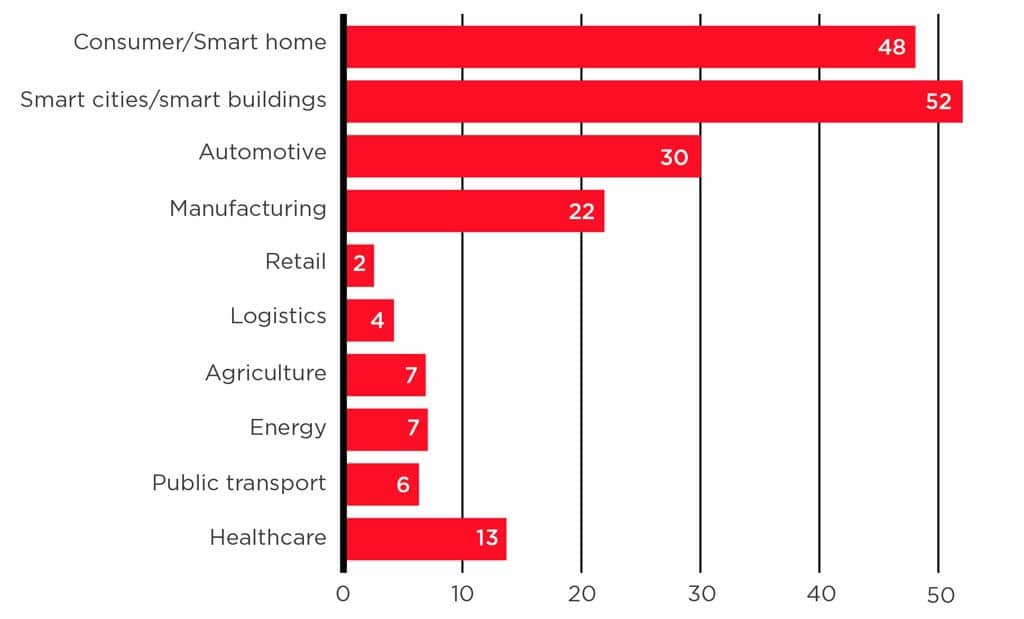

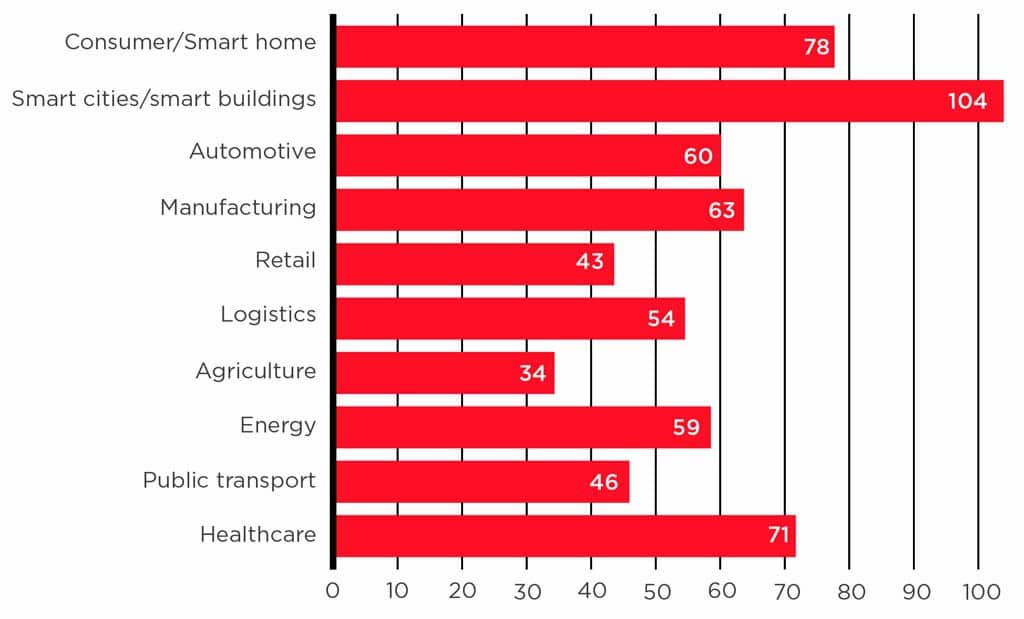

A number of verticals are expected to benefit from IoT edge implementations. Survey respondents regarded smart cities and smart buildings (27%) as well as consumer and smart home applications (25%) as the most likely to reap the greatest reward from the technology, though the automotive (16%), manufacturing (12%) and healthcare segments (7%) were also favored to gain upside from IoT edge deployments. However, other applications including agriculture (4%), energy (4%), public transport (3%) and retail (1%) were not expected to be primary beneficiaries.

In their own deployments, respondents said they mainly plan to use IoT edge technology for smart cities and smart buildings (17%), consumer and smart home (13%), health care (12%), manufacturing, automotive and energy (10% each).

Making IoT Edge a Reality

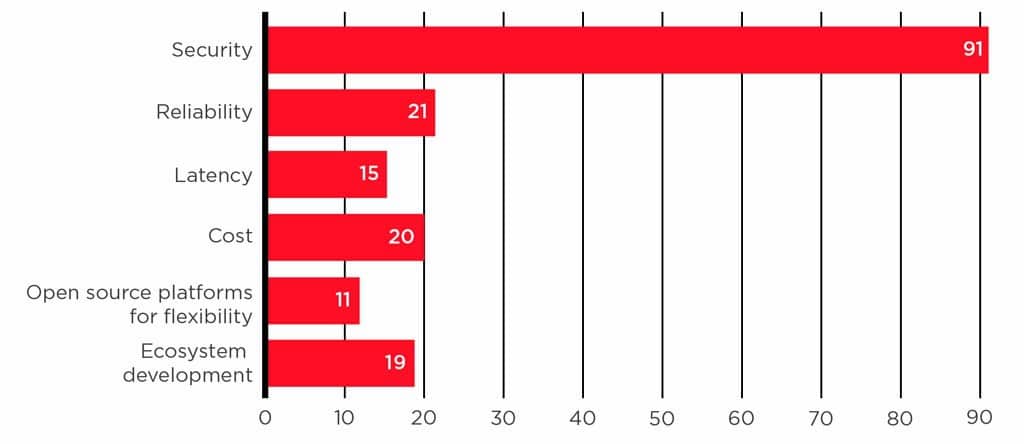

Though survey respondents seemed eager to take up IoT edge technology, they flagged a number of concerns and priorities which need to be addressed before deployments move forward. These included reliability (12%), cost and ecosystem development (11% each). However, security far and away topped the list, with 51% of respondents naming it as the primary issue the industry needs to tackle to facilitate widespread adoption.

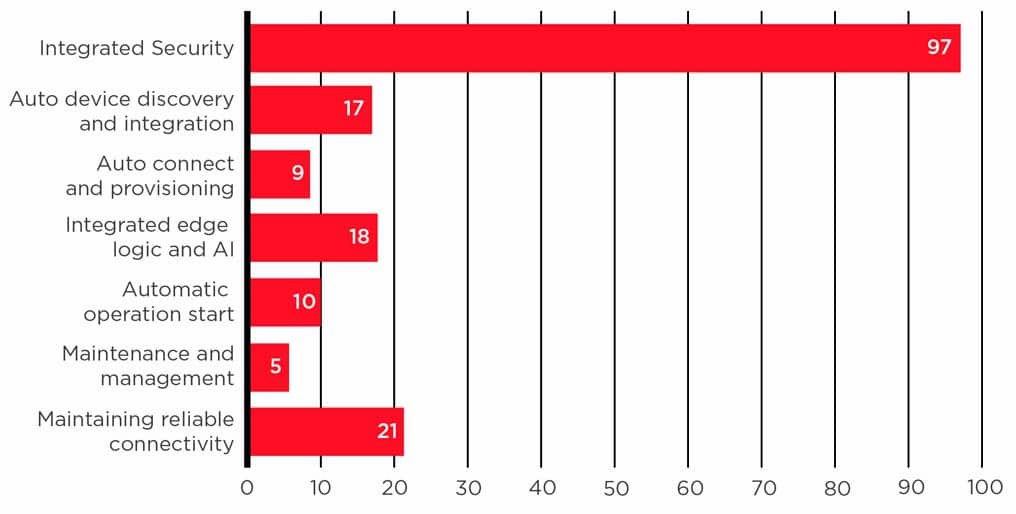

The focus on security proved to be a recurring theme in the survey. In another question, 55% of respondents pointed to integrated security as their top requirement from an IoT smart edge product. That response once again beat out other priorities by a wide margin, as just 12% of respondents selected reliable connectivity as their number one requirement. An additional 10% each named auto device discovery and integration, and integrated edge logic and AI as their most important requirements.

It is perhaps unsurprising that security was at the forefront of respondents’ minds given increased attention around IoT security of late, but it is important to note progress on this front is underway.

Various governments and industry groups have honed in on the issue as one of importance. In June 2018, more than a dozen mobile operators from across the globe committed to implementing IoT security guidelines laid out by GSMA.6

The GSMA guidelines address all players in the IoT ecosystem, including operators, manufacturers and developers, and offer best practices to ensure secure end-to-end design, development and deployment of IoT solutions. As the recommendations make clear, IoT security requirements span multiple layers, including the network, cloud and device.

The network element is already being addressed by the increased uptake of cellular IoT technologies, which are more secure than Wi-Fi-based technologies due to operators’ use of private, licensed spectrum and encryption for data transmissions. A number of companies are also tackling the issue of securing the cloud, where IoT data is stored and processed.

Survey respondents’ demand for integrated security was also addressed by the GSMA guidelines, which highlighted the role of embedded SIM technology in securing devices and enhancing identity management.

Unlike traditional SIM technology, which requires the use of a removable card in the device, a virtual embedded SIM ensures each is built with an identity during the manufacturing process. Such an on-device identifier serves as the encryption seed for all transmissions which occur and makes the devices more resistant to hacking since the encryption key is never transmitted over the network.

Conclusion

There is significant interest in the capabilities offered by IoT edge technology, with survey respondents pointing to the ability to reduce costs, increase efficiency, glean actionable insights and serve new use cases as the key attractions. However, many indicated they are still just learning about this technology and work needs to be done to close the knowledge gap.

Over the next three years, companies are increasingly expected to adopt IoT edge solutions, with the smart cities and buildings, smart home and automotive segments expected to reap the most reward from these implementations.

To ensure these deployments move forward, additional steps must be taken to resolve key concerns from interested parties, including finding ways to deliver increased reliability and reduce cost. Chief among industry priorities is security, which must be addressed across all layers — including the network, cloud and device — to facilitate widespread adoption of IoT edge technology.

Endnotes

- GSMA Intelligence, “IoT: the next wave of connectivity and services.” March 2018.

- MachNation, “Choosing the Right IoT Platform: Why the Edge is Critical to Your Success.” January 2018.

- It is important to note this report speaks specifically to the IoT Edge rather than the edge of the cellular radio access network (RAN). The term IoT Edge refers to the endpoint of the IoT information path, and should not be misconstrued with the edge of the RAN.

- See footnote 3.

- GSMA, “Mobile IoT in the 5G future: NB-IoT and LTE-M in the context of 5G.” April 2018.

- GSMA, “IoT Security Guidelines.” October 2017.

Disclaimer: The views and opinions expressed in this whitepaper are those of the authors and do not necessarily reflect the official policy or position of the GSMA or its subsidiaries.