Introduction

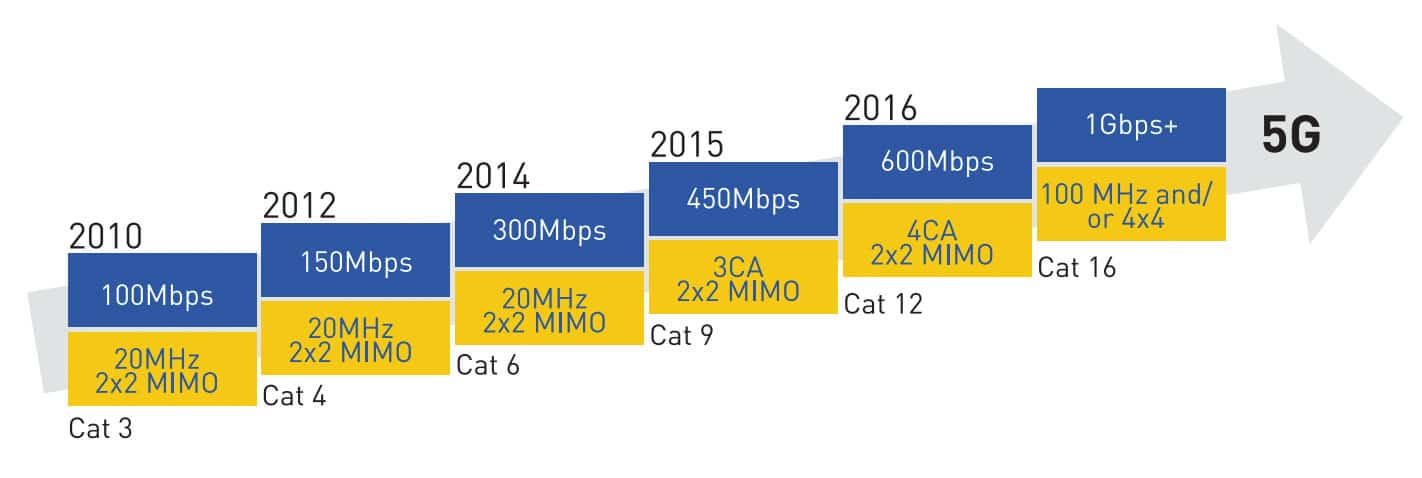

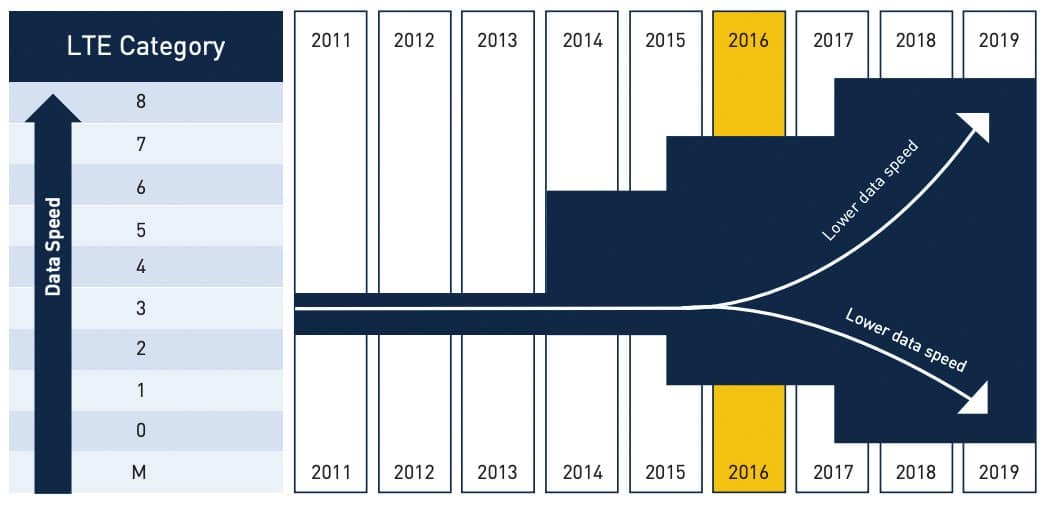

LTE, and more recently LTE-A (LTE-Advanced), are driving the wireless technologies for the near future becoming, with no doubt, the basis to build up the 5G ecosystem that will enable data transfer at speed above 1 Gbps. LTE commercial networks have moved in only a few years from initial Category (Cat) 3 running at download speeds of 100 Mbps, to Cat 4 up to 150 Mbps in a 20 MHz spectrum. 3GPP Release (Rel) 10 has then introduced the carrier aggregation (CA) technology bringing benefits not only for higher data rate but also for reducing traffic load. CA was first defined for Cat 4 with limited 10 + 10 MHz bandwidth allocation, but it has been only with Cat 6, with 20 + 20 MHz bandwidth allocation, that it has shown the compelling benefits of the technology raising the bar of the maximum downloading speed up to 300 Mbps. Since then, LTE-A has evolved towards a higher data rate not just as a result of aggregating more carriers but also by using enhanced modulation schemes, 256-QAM, as well as adding more MIMO streams, from 2 x 2 to 4 x 4 and above.

Cat 9 for instance aggregates three carriers (3xCA) to download data up 450 Mbps while Cat 12 reaches 600 Mbps by enabling a 256-QAM modulation scheme. Cat 16 will already hit the floor of the 5G minimum requirement of 1 Gbps combining CA techniques, as well as enabling 256-QAM modulation scheme and advanced MIMO 4 x 4 simultaneous downloading streams.

Picture 1 below indicates the evolution of LTE carrier aggregation highlighting the maximum speed for each LTE category used.

Moving beyond the next three- or four-year timeframe, the wireless world will more and more talk about 5G and how 5G will enable an ecosystem that allows going to data rate higher than 1 Gbps. However, 5G will not be based on just a single radio access technology (RAT) and the importance of LTE-A will still be fundamental in the future, as it is now. 5G will be in fact a bundle of existing wireless technologies and other vendor-based techniques, such as network function virtualization (NFV), software-defined networks (SDN), heterogeneous networks (HetNets), where LTE-A will be the key one for enabling more bandwidth over new frequencies in both licensed and unlicensed spectrum above 5 GHz.

Benefits of Carrier Aggregation

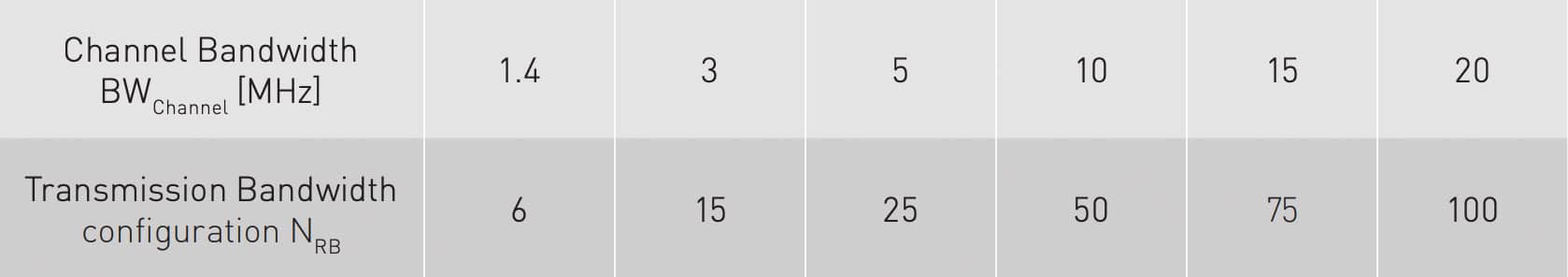

LTE is a packet switch, IP-based technology with orthogonal frequency-division multiple access (OFDMA) digital modulation scheme up to 20 MHz bandwidth requested to allocate the 100 resource blocks (RB)1 as defined by 3GPP RAN4. Table 1 below reports the number of RBs allocated at the different bandwidth configurations supported in LTE.

Based on this definition, the more straightforward way to reach higher data rates is to increase the bandwidth by aggregating two or more component LTE carriers, therefore consuming more RBs for transmitting data in a consecutive spectrum and fatter data pipe (Picture 2). However, the majority of mobile network operators (MNOs) do not hold more than 20 MHz channels in a single frequency band, and in addition, regulatory commissions worldwide have been assigning different bands of radio spectrum that are not interoperable, resulting in a very high fragmentation of the LTE spectrum. There are already more than 40 frequency bands in use depending on which region or country across the world LTE has been deployed, and 3GPP Rel 13 will define LAA (License Assisted Access) in addition to LTE-U (LTE in unlicensed spectrum) to extend the use of bands in the unlicensed spectrum over the 5 GHz. With LAA/LTE-U, it will be possible for MNOs to aggregate carriers over licensed spectrum, to maintain critical information and guaranteed quality of service, with carriers over unlicensed spectrum, to improve data speeds as well as to boost network capacity.

CA definitely enables users to reach competitive data rates aggregating LTE carriers components spread across the fragmented licensed and unlicensed spectrum as never before, allowing MNOs to turn their investment in both LTE technology and acquisition of carriers into marketable higher data rates. At the same time, as said earlier, CA also increases capacity for typical network loads that are generally bursty, as for smartphone applications or web browsing and mail messaging.

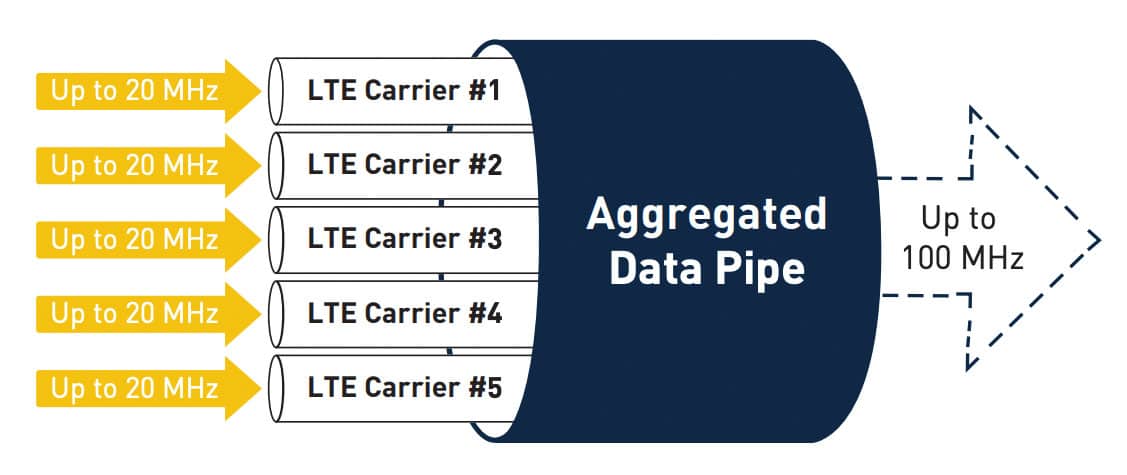

The graph in Picture 3 describes as CA increases the burst rate for all users in the cell by around ~50% reducing over-the-air latency. As well, by maintaining the user experience unchanged (same burst rate) and aggregating two carriers, the network can support more users for partially loaded carriers, meaning that more loading can be supported while providing the same user data rates and experience5.

Obviously, the gain depends on the load and, while it can exceed 100% for fewer users (less loaded carrier), it can be less for many users. The curve assumes that load balancing is done at the beginning of the packet calls, and the normalized burst rate is taken compared to the average load.

Market Analysis

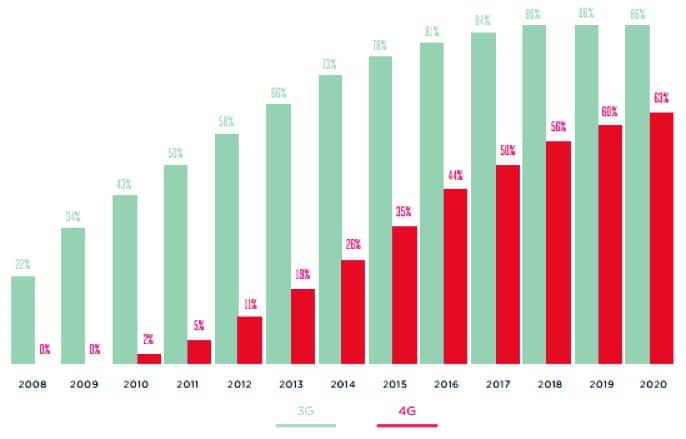

Mobile wireless networks and specifically LTE-A will, with no doubt, see extraordinary growth across both developed countries and developing regions aiming to cover most of the population around the world by 2020. According to GSMA4, 4G LTE will reach 63% of the population while almost 100% will be covered when combined with 3G technologies, as reported in the graph in Picture 4. The comparison of 4G versus 3G coverage also shows as the latter is leading to a flat trend.

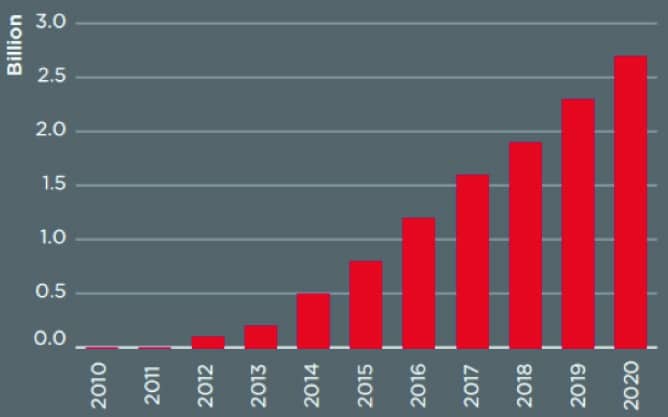

By 2020, more than 30% of global connections will run on LTE, compared to 7% only in 2014, reaching over 2.5 billion connections worldwide with a CAGR of over 30%.4 It is worth noting that those numbers exclude the M2M/IoT connections that also will take advantage of the LTE lower categories (Cat M, NB-IoT) that are designed to offer special features for this market while lowering LTE costs and complexity for those applications that do not need high-performance data rate.

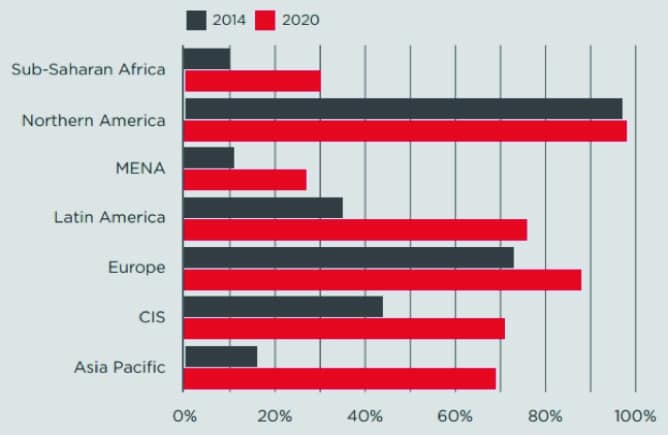

Picture 5 visualizes this scenario highlighting the compelling growth for LTE subscribers, while Picture 6 below reports the breakdown of LTE population coverage by Region in the years from 2014 to 2020. It is evident from the graph that while developed countries have already reached most of their population, the big growth and investments concentrate on the developing countries that are still much behind in their deployment of LTE networks.

While traditional revenue sources, as mobile voice and texts, have apparently reached their maturity in a number of markets and are seeing their profits progressively declining, LTE and LTE-A are empowering fast data flow that is demanded by the new digital society. The mobile market is therefore moving towards the development of applications in the data traffic ecosystem generating new sources of revenue. As far as the technology to adopt is concerned, LTE-A broadband is gaining traction as a method for optimizing network resources and available spectrum, enabling new high data rate services and offload networks.

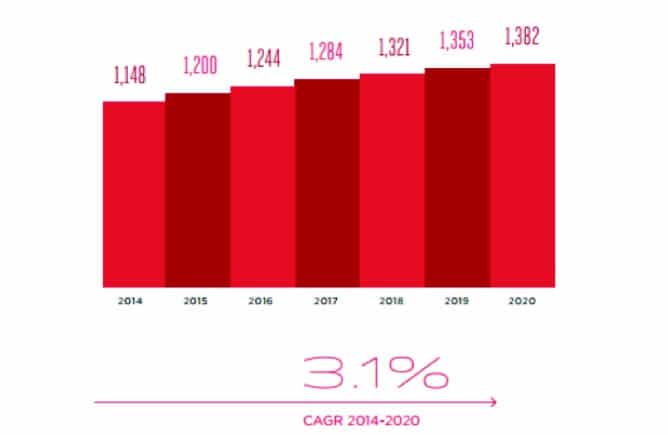

According to GSMA4, data growth is driving revenues with a CAGR of 3.1% between 2014 and 2020 motivating operators to have significant investments for the rollout of high-speed networks. This tendency is shown in the graph in Picture 7.

The demand for data is accelerating and this is not just true for mobile networks where data already generating 95% of its world’s total traffic, but also on fixed-line networks. This enormous data consumption, mainly driven by video streaming and internet browsing, requires high-speed networks. In turn, this is pushing operators to provide broadband solutions on both mobile networks, foremost LTE and LTE-A and fixed-line networks with FTTH (optical fiber) rather than DSL where possible, and therefore defining and creating new bundle plans combining mobile and fixed services.

MNOs that hold fixed-line infrastructures have a competitive advantage to converge their offering. For the remaining, including all mobile virtual network operators (MVNOs), LTE broadband is giving the opportunity for extending their mobile LTE proposition to include fixed-LTE services for seamless high-speed connectivity. On the other side, MNOs will also need to take into account the deployment cost for the FTTH lines while investments for LTE networks have already been made for smartphones mobiles, amortizing the costs. In the developed market, the optical fiber technology is having indeed good traction in densely populated areas but it is very likely that fixed-LTE will challenge the fixed-line connectivity in those areas that lack fixed broadband infrastructure, like rural areas. However, this split is not by any means net. In fact, another solution that is gaining momentum, not just limited to rural areas, is to take advantage of the existing DSL line and, instead of investing in new FTTH deployment that can be too expensive, to combine it with fixed-LTE broadband to give a hybrid solution (DSL+LTE) for much higher data throughput.

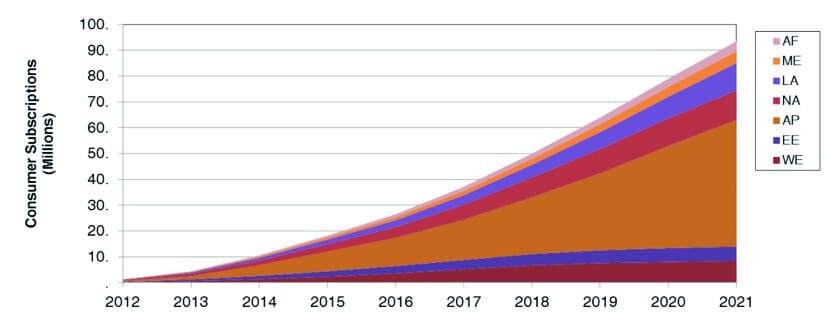

The mobile broadband growth will be even more compelling in emerging markets where revenues are driven by different social and economic factors like rising populations, strong economic growth and a lack of alternative fixed-line infrastructure. In those areas, mobile networks are the preferable technology to adopt, as it is easier, faster and more cost-effective to deploy. ABI Research estimates that global fixed-LTE broadband service is expected to surpass 26.5 million subscribers in 2016 and to reach almost 100 million subscribers by 2021 with a CAGR of almost 30%3 as reported in Picture 8.

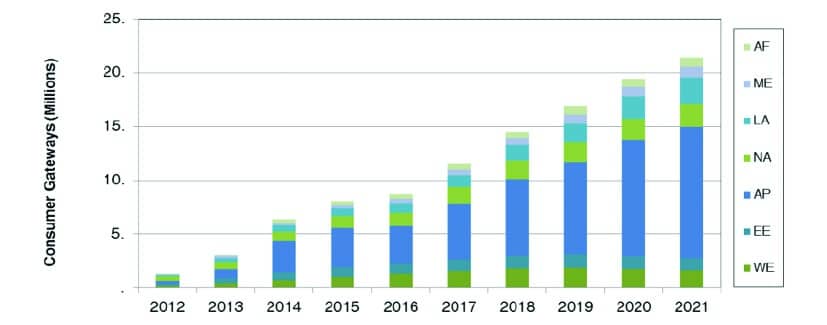

The rapid adoption of LTE technologies in the data consumption business, the increasing of LTE network coverage and bandwidth capacity that allows areas with poor or no fixed-line broadband to get high-speed connectivity via fixed-LTE deployment, offer important opportunities for customer premises equipment (CPE) manufacturers originally selling fixed-line connectivity. CPEs and chipset vendors are starting to see a growing demand for LTE modems embedded in routers and gateways with shipments expected to increase. Picture 9 depicts what ABI Research forecasts about the worldwide fixed-LTE broadband CPE shipment that is expected to grow from over 8 million units in 2016 to over 21 million units in 2021 with a CAGR of 19.7%.3

Telit’s Proposition

LTE and LTE-A provide a ground-breaking combination of efficiency and flexibility with the ability to combine high-speed, low-latency transmission with cost-effective and low-bit-rate services enabling economies of scale. Hereby, in the years to come, LTE will be definitely developing in two diverting and complementary fronts.

From one side LTE MTC (machine-type communications) designed for low data rate and low traffic, will gain momentum from the 3GPP Rel 13 onwards forcing OEMs to adopt more and more LTE solutions that will consolidate in commercial deployment of IoT applications, where Telit is a market leader.6 On the other side, LTE and LTE-A offer great opportunities not only for the smartphone market but also for industrial and residential routers and gateways and set-top-box CPE manufacturers that will benefit from the existing and growing mobile operators LTE infrastructure.

This future LTE market trend is well summarised in Picture 10 where Telit foresees interesting growth opportunities both within its consolidated core business toward lower data rates and in new segments toward higher data speed applications.

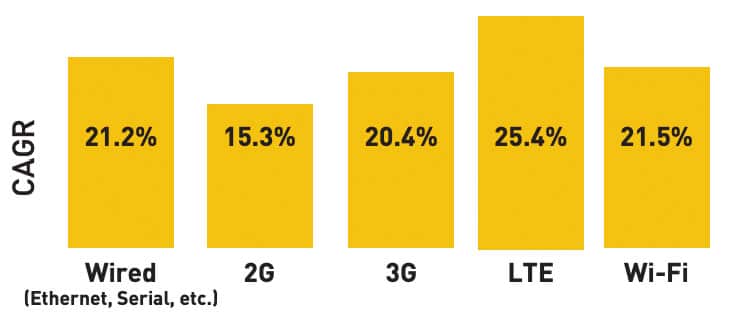

As far as the latter is concerned, as earlier discussed in the market research, the LTE adoption is growing in both developed and developing countries giving opportunities to the fixed-LTE broadband for challenging the fixed-line connectivity where it is limited, or poor, or where investment costs to deploy the next-generation network (NGN), typically FTTH (optical fiber), becomes too expensive. ABI Research foresees growth in shipment of both wired and wireless routers/gateways from 2016 to 2021 with those based on fixed-LTE having the higher CAGR rate, as reported in Picture 11.

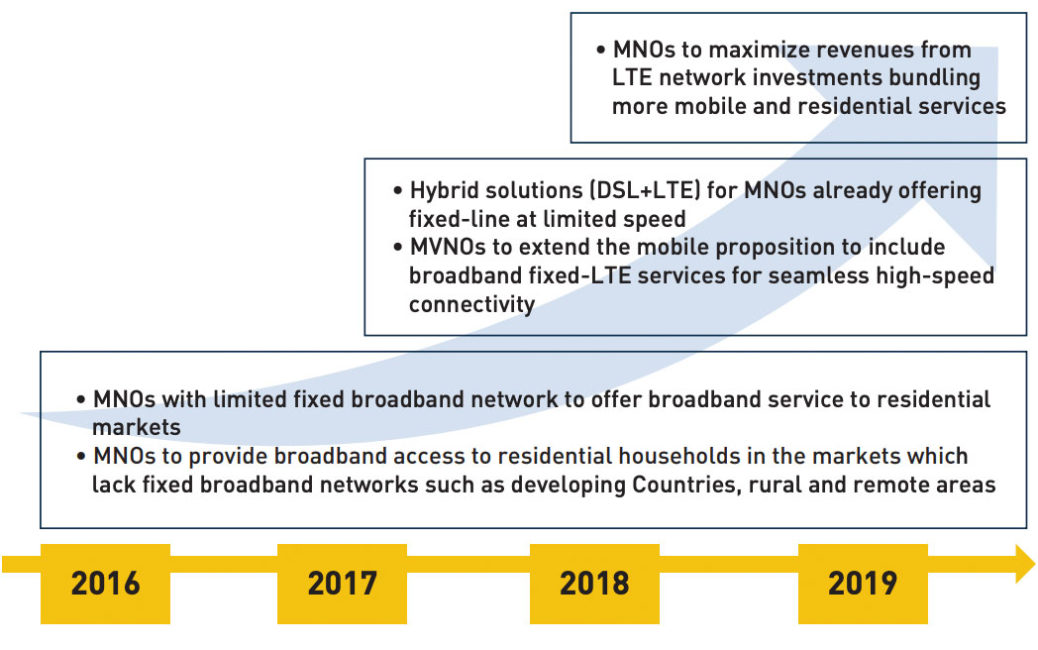

Picture 12 provides an overview of the opportunities in the fixed-LTE broadband market that Telit foresee for the next three or more years. Beyond that time lap, more attention will be given to the 5G ecosystem and its enhanced features, even if LTE will continue to be bundled under the “5G umbrella” and will remain the key technology to enable higher data rates and to be consolidated as a source of revenue.

MNOs and MVNOs will create opportunities for residential services where the technology in use will have less and less relevance as long as the end user will experience seamless connectivity. Therefore, fixed-LTE will not be just limited to rural areas and developing countries, but it will also grow in combination with DSL in hybrid solutions. In the longer term, MNOs will continue to maximize their revenues and ROI adding and bundling more and more mobile and fixed services taking advantage of the existing technologies deployed, regardless of being wired or wireless.

On the other side, the highly fragmented LTE spectrum adds complexity to the CPEs’ radio frequency (RF) front-end. As LTE counts already of many frequencies in use across the world, that will become more and more when operators enable LAA/LTE-U for the unlicensed spectrum over the 5 GHz band, this spectrum fragmentation is a big concern for both manufactures and MNOs. The additional RF front-end complexity has in fact obvious consequences for both the cost and size of the modem. However, while the latter is not a big concern in a gateway/router design that has enough room to host a wider LTE module, price is instead a key driving factor for both CPE manufacturers in the selection of their suppliers and for MNOs to select the end-user product, especially for products shipped to developing countries.

Telit has therefore designed its new generation of LTE-A modules for fixed-LTE routers and gateways limiting the number of frequency bands strictly to those demanded by the targeted market reducing the RF front-end complexity and BOM (bill of materials) cost.

Telit LE922A6 family is based on the LGA form factor (Picture 13) that well suites both the residential and the industrial segments where requirements for improved robustness, as well as extended temperature range, are more demanding. LE922A6 products are Cat 6 LTE-A modules optimized for two-carrier aggregation up to 40 MHz bandwidth, reaching high throughput up to 300 Mbps downlink and 50 Mbps in uplink, and supporting MIMO 2 x 2 streams. LE922A6 is available in different variants to fulfill the current requirements of the Australian and European markets. Additional SKUs (stock-keeping units) for multiple regional variants are in planning to support distinct bands and band combinations to cover more markets worldwide, such as North America and LATAM.

As anticipated above, all these modules are particularly well suited but not limited to being embedded into those devices that have extremely high data throughput requirements, such as mobile broadband gateways and routers, taking the benefit of the most advanced 3GPP Rel 10 LTE connectivity. A few examples of use cases can be:

- Back-up connectivity when primary wired-line internet connections are not available, ensuring seamless connectivity to the end users

- Hybrid connectivity combining DSL and LTE data stream to enhance data rate

- Mobile hotspots with Wi-Fi connectivity

The next generation of modules is looking at an even higher data rate to host Cat 9 devices (Picture 14) capable of aggregating up to three carriers for a bandwidth of 60 MHz and data throughput up to 450 Mbps. This new LE942 family will be also available in the LGA form factor and will follow the same concept as LE922A6 for frequency and cost optimization. The new modules will be fully backward pin-to-pin compatible according to the “nested” philosophy that enables reusing legacy design on ungraded modules and therefore reducing design costs for the CPE manufacturers.

LE942 family will also be capable of Cat 12 data speed when enabling 256-QAM modulation over 3xCA allowing it to reach up to 600 Mbps.

Conclusion

The wireless world is moving fast towards the adoption of LTE technologies and LTE networks, gaining momentum from the worldwide demand of the digital society that sees the world as a global entity where everything is connected, and therefore consuming more and more data. Operators are therefore expected to increase their investments in LTE technology to enable higher circulation of data traffic for new revenues from the data services, as browsing and video, while revenues for the traditional voice services will progressively decline. The new revenues on data are shifting the mobile broadband ecosystem to meet new opportunities for new services not just limited to Smartphones but also for fixed-LTE CPE manufacturers that will see shipment growth.

In the years to come, industrial and residential routers and gateways will be deployed in a combination of wired and fixed-wireless technologies complementing each other according to the market and MNOs providers. Both wired NGN technologies, especially for FTTH lines and fixed-LTE broadband, will grow with the latter having the compelling advantage of using the same wide LTE coverage, as well as using the same operators’ investments, made for the smartphone market absorbing most of the deployment costs. Mobile wireless coverage will in fact continue to increase with a target to reach close to 100% of the population before 2020 and become the preferable solution for fixed broadband in rural areas and developing countries. As well, LTE will be the preferable technology to use for those operators and MVNOs that want to enhance their mobile services proposition by bundling their mobile and fixed-LTE broadband plans.

Existing DSL lines will not be entirely replaced by optical fibers due to the high deployment cost of the latter and will be boosted instead through Hybrid solutions in combination with LTE technologies. With the hybrid solution (DSL+LTE) operators can offer fixed-line stability with a much higher data rate at very limited added costs for their investments.

Moving forward, LTE is also paving the basis for the 5G ecosystem. LTE will in fact remain the key technology blended with preexisting technologies spacing from 2G, 3G, 4G, Wi-Fi and other vendor-based techniques (e.g., NFV, SDN, HetNets), that allow the network to guarantee higher coverage, flexibility, availability and capacity.

This new ecosystem will create even more opportunities for the IoT and broadband industry where Telit is well positioned with its broad portfolio to lead the market.

Endnotes

- 3GPP TS 36.101 V12.9.0, Technical Specification Group Radio, October 2015.

- LTE and the Path to LTE MTC, Telit, July 2015.

- Fixed-LTE Broadband Service, ABI Research, April 2016.

- The Mobile Economy, GSMA, 2015.

- LTE-Advanced, Qualcomm, August 2014.

- Leading the Path to LTE Machine-Type Communications: Part 1 and Part 2, Ken Bednasz, Telit, March and April 2016.